Wie man lernt, Intraday zu handeln und keine Angst vor einem Stop-Loss zu haben

00:00:00 In diesem Abschnitt, Das Video erörtert die Bedeutung einer starken theoretischen Grundlage im Daytrading. Ohne ein solides Verständnis der Grundlagen, Es können Probleme auftreten, die Händler daran hindern, zu beurteilen, ob sie die richtigen Entscheidungen treffen. Zu den häufigen Problemen, die auftreten können, gehört, dass der Kauf oder Verkauf zu weit vom Zielniveau entfernt ist, den Fortschritt eines Instruments nicht berücksichtigen, und es werden nicht genügend Untersuchungen zu den zugrunde liegenden Faktoren durchgeführt, die den Marktbewegungen zugrunde liegen. Um im Daytrading erfolgreich zu sein, Es ist von entscheidender Bedeutung, ein fundiertes Verständnis grundlegender Konzepte wie kurzer Zeitrahmen und der Interpretation von Marktsignalen zu haben.

00:05:00 In diesem Abschnitt, Den Händlern werden zwei Diagramme gezeigt, die verschiedene Szenarien der Preisbewegung darstellen, und sie werden gefragt, welches ihrer Meinung nach wichtiger ist. Die richtige Antwort ist das zweite Diagramm, was eher zu einer Konsolidierung als zu einem Rückgang der Volatilität führt. Anschließend wird im Video die Bedeutung von Akkumulationsperioden für große Händler erörtert und wie man diese Perioden mithilfe der Diagrammanalyse erkennt. Es wird auch betont, wie wichtig es ist, ein Handelssystem speziell für den Impulshandel zu haben. Endlich, Das Video zeigt ein reales Handelsbeispiel am Beispiel der Tesla-Aktie.

00:10:00 In diesem Abschnitt, Der Sprecher erklärt, wie es geht Handel innerhalb eines Tages, ohne Angst vor einem Stop-Loss haben zu müssen. Er spricht darüber, wie wichtig es ist, das Instrument zu verstehen, mit dem Sie handeln, und das Erkennen, wenn das Instrument nicht zurückrollt, Es hat keinen Sinn, es verkaufen zu wollen. Er betont auch die Notwendigkeit, dass Händler jeden Tag ihre Hausaufgaben machen, um ihr Hauptproblem zu lösen, der menschliche Faktor. Er rät davon ab, Zeit mit Fragen zu Themen zu verschwenden, die Händler bereits kennen sollten, und empfiehlt, sich auf das Lernen zu konzentrieren, anstatt andere zu beeindrucken.

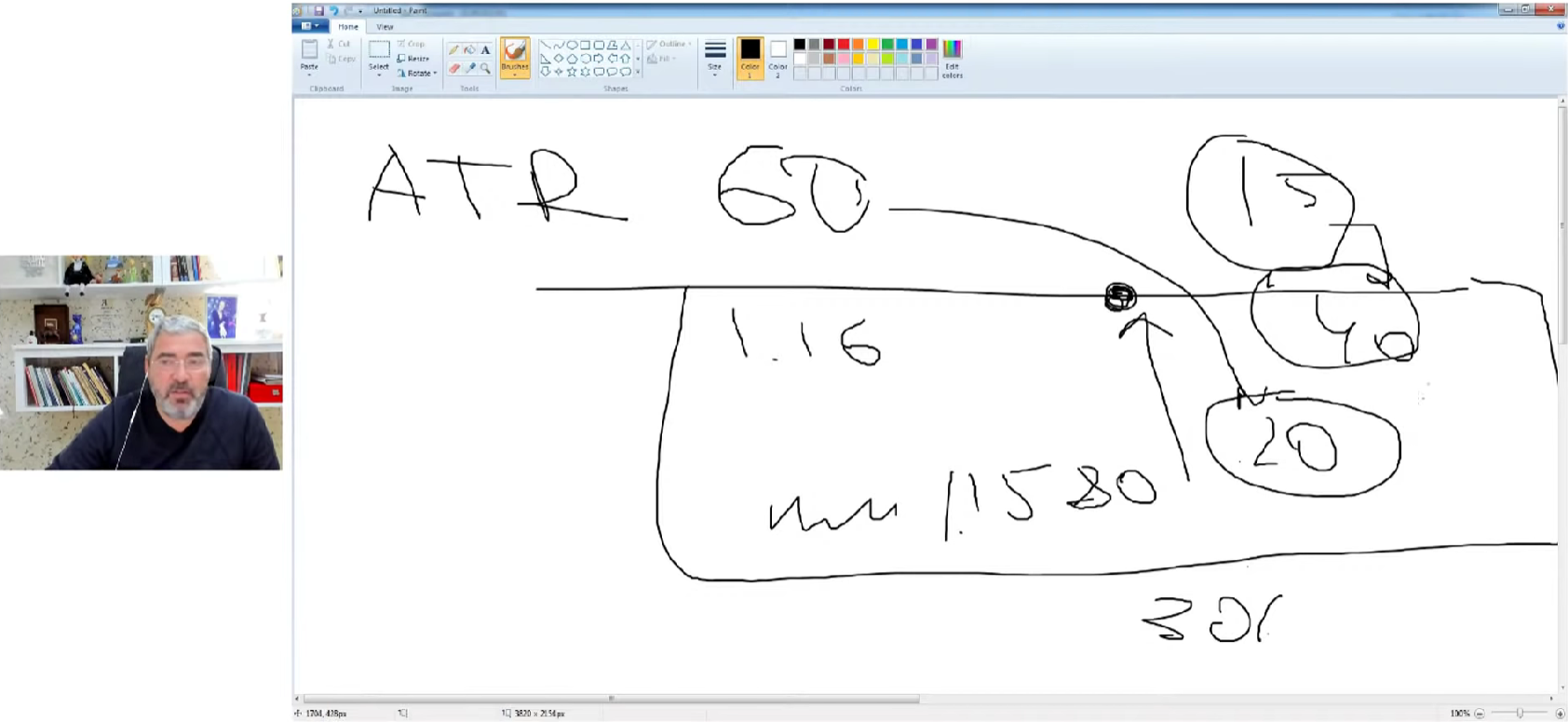

00:15:00 In diesem Abschnitt, Der Referent erläutert das Konzept der Bad Volatility am Beispiel der Euro-Währung. Er schlüsselt die technische Analyse anhand eines Diagramms auf, Berechnen Sie dies, um ausgehend vom aktuellen Stand der Währung ein sichereres Niveau zu erreichen, Ein Werkzeug muss ausgegeben werden 23 Punkte, was auf eine schlechte Volatilität schließen lässt. Außerdem, Er warnt davor, wenn man einen Handel eingeht, Sie müssen bedenken, dass sie immer nur ein Mindestverhältnis von drei zu eins haben werden, Daher müssen sie auf die Höhe ihrer Stop-Losses achten.

00:20:00 In diesem Abschnitt, Der Redner betont, wie wichtig es ist, die Grundprinzipien des Tageshandels zu verstehen und gültige Einstiegspunkte für jedes Instrument zu finden. Er erwähnt die Notwendigkeit von Energie und finanziellen Ressourcen für einen erfolgreichen Handel und rät Händlern, auf wirklich wichtige Werte zu achten und positive Signale zu erzeugen. Der Referent erklärt auch, dass Muster mit unerwarteten Ergebnissen für den Handelsprozess irrelevant sind, die auf Regelmäßigkeiten basieren sollte. Endlich, Er schlägt vor, sich ein Webinar anzusehen oder Hausaufgaben zu machen, um dieses Verständnis zu erlangen.

00:25:00 In diesem Abschnitt, Der Redner erörtert, wie wichtig es ist, über eine solide theoretische Grundlage zu verfügen, bevor man versucht, mit Instrumenten zu handeln. Er betont die Notwendigkeit, die Grundlagen zu verstehen und sich bei der Auswahl von Ein- und Ausstiegspunkten nicht einfach auf zufällige oder oberflächliche Indikatoren zu verlassen. Anhand verschiedener Beispiele und Diagramme, Der Referent zeigt, dass erfolgreiches Trading eine sorgfältige Analyse und Liebe zum Detail erfordert, und dass es bei Nichtbeachtung zu erheblichen Verlusten kommen kann.

00:30:00 In diesem Abschnitt, Der Redner betont, wie wichtig es ist, ein Handelssystem zu schaffen und es ohne Emotionen einzuhalten. Anschließend zeigt er Beispiele für Handelsszenarien auf dem amerikanischen Markt und erklärt, wie man den menschlichen Faktor beim Handel eliminieren kann, indem man Levels verwendet und beschreibt, warum bestimmte Trades funktionieren könnten. Der Redner betont auch, wie wichtig es ist, die Grundlagen des Handels zu verstehen und einige Wochen lang zu üben, ohne tatsächlich zu handeln, um ein Verständnis für die Marktbedingungen und das Verhalten verschiedener Instrumente zu erlangen. Gesamt, Die wichtigste Erkenntnis besteht darin, einen systematischen Ansatz für den Handel zu haben und den Markt zu verstehen, bevor Entscheidungen getroffen werden.

00:35:00 In diesem Abschnitt, Der Redner spricht das Problem an, dass Händler große Mengen kaufen, ohne einen Plan oder Stop-Loss zu haben. Er betont, wie wichtig es ist, vor dem Handel eine Strategie für Einstiegspunkte und Stop-Losses zu haben. Der Redner beantwortet auch Fragen der Zuschauer zur Notwendigkeit von Empfehlungen ohne Stop-Losses und erklärt, dass der Zweck seines Kanals darin besteht, Händlern Orientierung und Aufklärung zu bieten, anstatt nur Signale zu geben. Er betont, dass Händler den Markt verstehen und lernen müssen, richtig zu handeln, um dauerhaften Erfolg zu erzielen, anstatt sich auf Signale oder Tipps zu verlassen. Endlich, er schlägt vor, ein physisches Objekt zu verwenden, wie zum Beispiel ein Hammer, sich selbst zu bestrafen, wenn man gegen Handelsregeln verstößt, um die Disziplin zu verbessern und zu vermeiden, dass dieselben Fehler gemacht werden.

00:40:00 In diesem Abschnitt, Der Sprecher empfiehlt, seinen Kanal zu abonnieren und das Buch zu kaufen „Aktiver Trader-Kurs“ für diejenigen, die Daytrading erlernen möchten. Sie versichern den Zuschauern, dass das Buch antworten wird 90 Prozent ihrer Fragen und enthält Informationen zur technischen Analyse. Der Redner erwähnt auch ihren Telegram-Kanal und ihren Online-Kurs, Für diejenigen, die nicht über die nötigen Mittel verfügen, empfiehlt es sich jedoch, mit dem Buch zu beginnen. Sie betonen, wie wichtig es ist, zuzuhören und zuzuhören, wenn es um den Handel geht, und wünschen dem Publikum viel Glück bei seinen Bemühungen.

-

Das Video ist eine umfassende Anleitung für das Daytrading.

-

Es betont die Bedeutung einer starken theoretischen Grundlage und eines systemischen Handelsansatzes.

-

Es ist von entscheidender Bedeutung, grundlegende Konzepte wie kurze Zeitrahmen und die Identifizierung gültiger Einstiegspunkte zu verstehen.

-

Anhand von Beispielen und Diagrammen wird veranschaulicht, wie wichtig eine sorgfältige Analyse und die Liebe zum Detail sind.

-

Es wird Wert darauf gelegt, über ein Handelssystem zu verfügen, das speziell auf den Impulshandel ausgerichtet ist, um den emotionalen Faktor aus dem Handel zu entfernen.

-

Für den langfristigen Erfolg ist es wichtig, den Markt zu verstehen.

-

Das Video empfiehlt das Buch „Aktiver Trader-Kurs“ für Händler, die Daytrading erlernen möchten.

Video rein Russisch „Wie man lernt, Intraday zu handeln und keine Angst vor einem Stop-Loss zu haben“

Das Video bietet eine umfassende Anleitung zum Daytrading, Betonung der Notwendigkeit, dass Händler über eine solide theoretische Grundlage und einen systemischen Handelsansatz verfügen. Der Redner erörtert die Bedeutung des Verständnisses grundlegender Konzepte, wie zum Beispiel kurze Zeitrahmen, und Erkennen gültiger Einstiegspunkte für jedes Instrument. Verschiedene Beispiele und Diagramme verdeutlichen die Notwendigkeit einer sorgfältigen Analyse und Liebe zum Detail. Das Video unterstreicht auch die Bedeutung eines Handelssystems speziell für den Impulshandel, Entfernen des emotionalen Faktors aus dem Handel, und den Markt verstehen, um dauerhaften Erfolg zu erzielen. Endlich, Das Video empfiehlt das Buch „Aktiver Trader-Kurs“ für Händler, die Daytrading erlernen möchten.