Ein Service zur Börsenanalyse

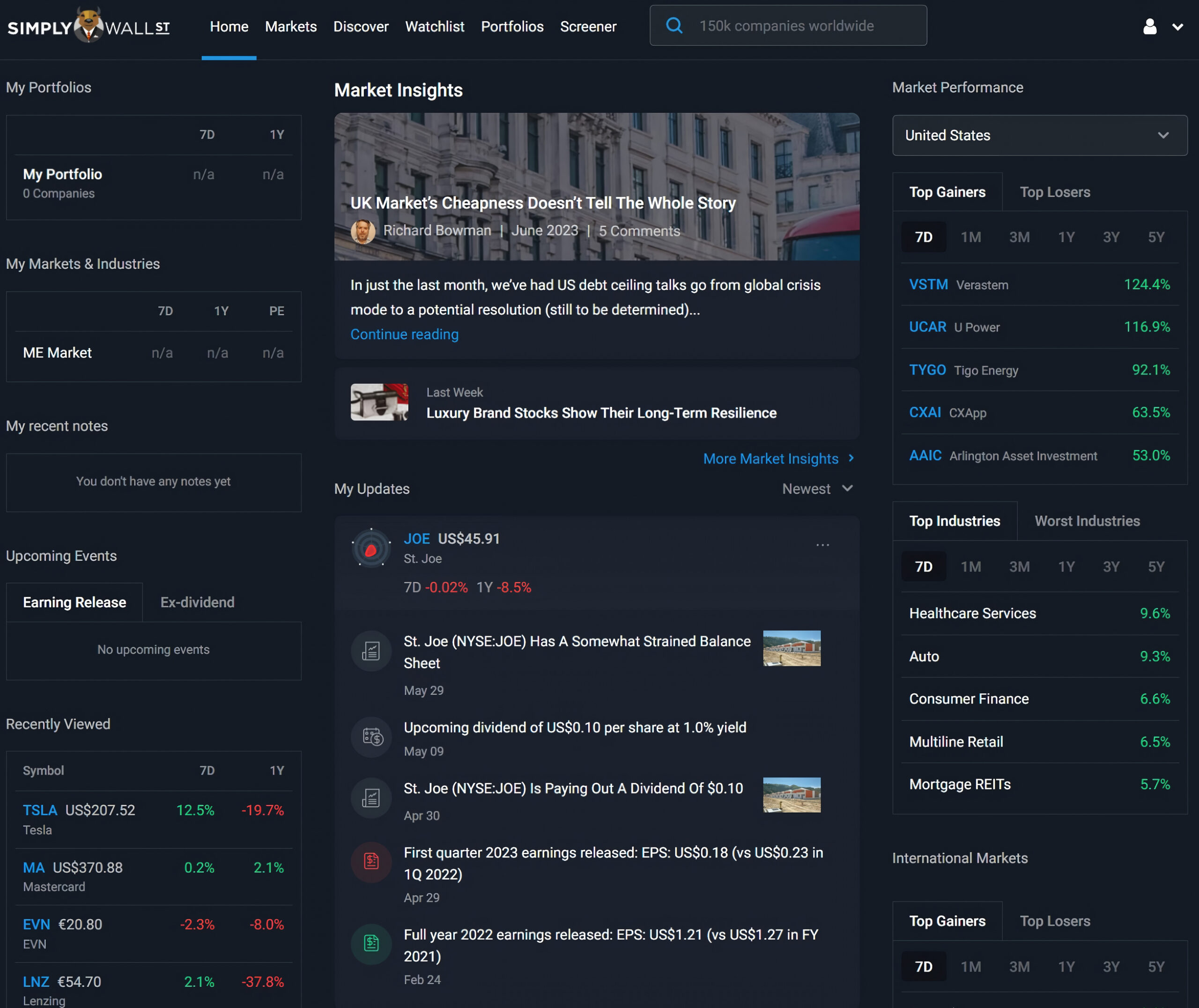

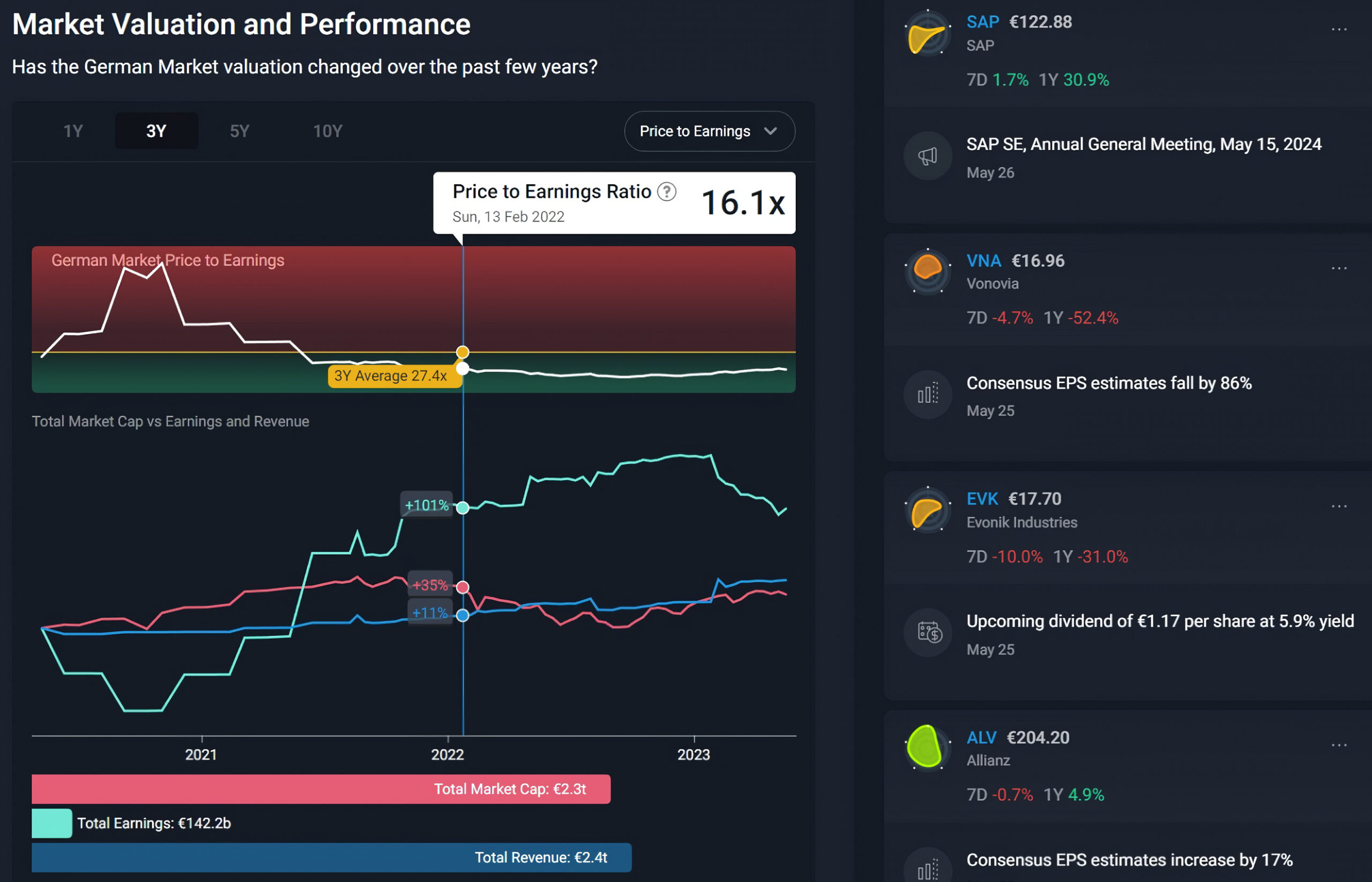

Anleger, die heute umfassende Börsenanalysen und -tools suchen, verfügen über eine wertvolle Ressource Einfach Wall St. Mit Schwerpunkt auf der Analyse und Prognose des US-Aktienmarktes, Simply Wall St bietet detaillierte Einblicke in Aktien basierend auf ihrer finanziellen Leistung, Bewertung, Dividenden, zukünftiges Wachstumspotenzial, und Risiko. Es bietet eine intuitive Benutzeroberfläche, interaktive Diagramme, Infografiken, Berichte, und Portfoliomanagementfunktionen, Damit ist es die beste verfügbare Börsenanalyse-App und Website.

1. Simply Wall St. verstehen

1.1 Die Notwendigkeit einer perfekten Börsenanalyse

Simply Wall St wurde im Jahr gegründet 2014 von Al Bentley und Nick van den Berg, ehemalige Softwareentwickler, die die Notwendigkeit eines effizienteren und benutzerfreundlicheren Ansatzes für die Börsenanalyse erkannten. Ihre Vision war es, einen Service zu schaffen, der die perfekte Balance zwischen Einfachheit und umfassender Analyse bietet.

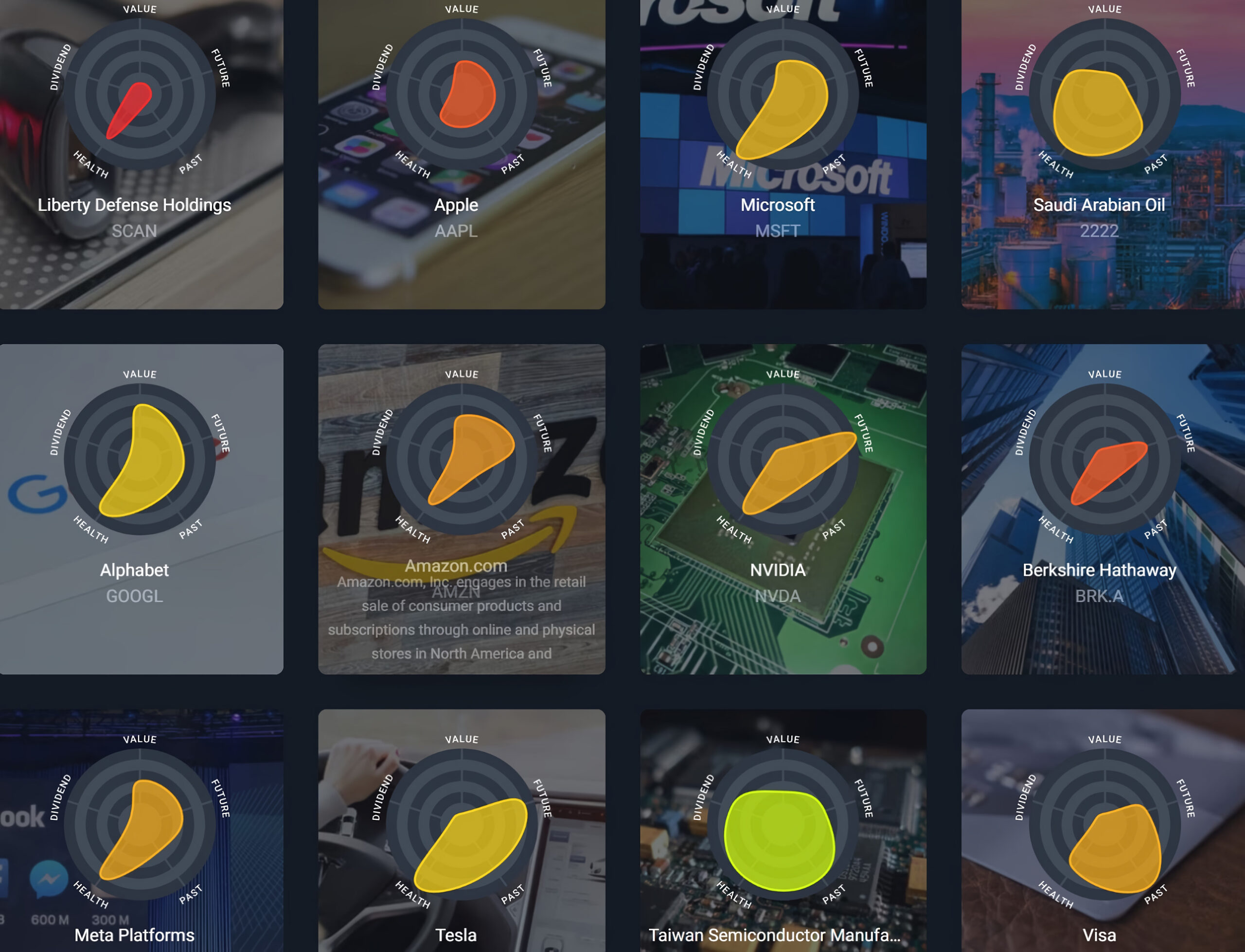

1.2 Das einzigartige Schneeflockenmodell

Im Mittelpunkt der Analyse von Simply Wall St steht das innovative Schneeflockenmodell. Dieses Modell verdichtet die wesentlichen Aspekte einer Aktie in einer optisch ansprechenden Grafik. Durch die Bewertung von fünf Kriterien: Wert, zukünftiges Potenzial, vergangene Leistung, finanzielle Gesundheit, und Einkommen – das Schneeflockenmodell bietet eine schnelle und intuitive Momentaufnahme der Bilanz und des Potenzials einer Aktie.

2. Umfassende Analysetools

2.1 Detaillierte Kriterienanalyse

Simply Wall St zeichnet sich durch die Bereitstellung einer detaillierten Analyse jedes Kriteriums im Schneeflockenmodell aus. Durch gründliche Wertprüfung, zukünftiges Potenzial, vergangene Leistung, finanzielle Gesundheitsindikatoren, und Einkommensgenerierung, Anleger können ein umfassendes Verständnis der Stärken und Schwächen einer Aktie erlangen.

2.2 Vergleichende Analysetools

Anleger können die Tools von Simply Wall St nutzen, um Aktien mit denen ihrer Branchenkollegen oder dem Marktdurchschnitt zu vergleichen. Diese Funktionalität ermöglicht eine kontextbezogene Bewertung der Performance einer Aktie im Vergleich zu ihren Konkurrenten, Unterstützung bei Entscheidungsprozessen.

3. Umfangreiche Berichterstattung und prädiktive Einblicke

3.1 Große Marktreichweite

Simply Wall St verfügt über eine beeindruckende Abdeckung von über 75,000 Bestände quer 91 Märkte weltweit. Diese ausgedehnte Marktreichweite stellt sicher, dass Anleger in jedem Sektor und jeder Region Chancen finden können, Dies macht es zu einer unverzichtbaren Ressource für die globale Marktanalyse.

3.2 Zugängliche prädiktive Erkenntnisse

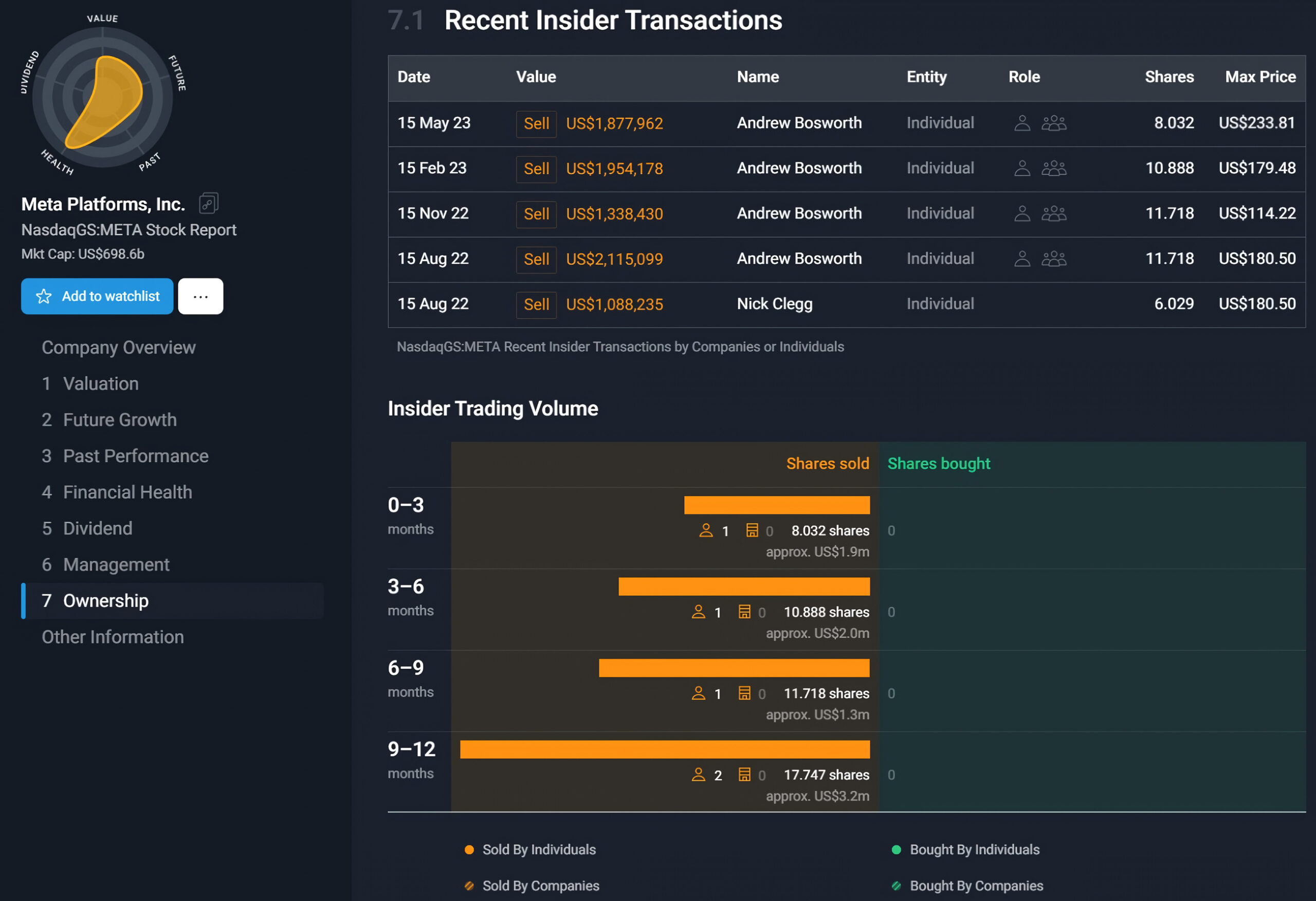

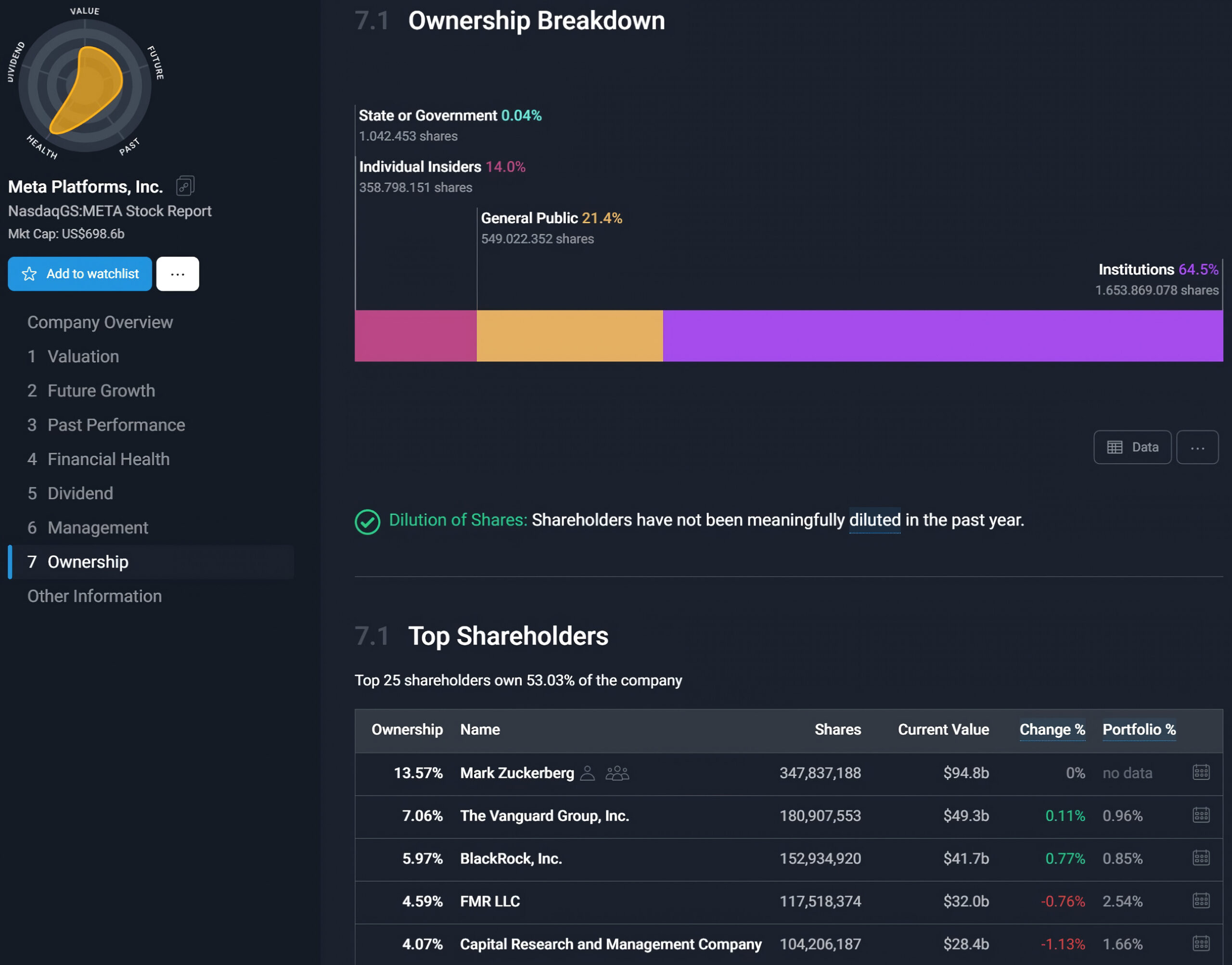

Um Anlegern dabei zu helfen, fundierte Entscheidungen zu treffen, Simply Wall St bietet Zugang zum Analystenkonsens, Insider Handelsinformationen, Eigentümerstruktur, Beurteilung der Ertragsqualität, und mehr. Diese prädiktiven Erkenntnisse helfen Anlegern, Markttrends und potenzielle Risiken vorherzusehen.

4. Intuitive App und benutzerfreundliche Website

4.1 Beste Börsenanalyse-App

Simply Wall St zeichnet sich aufgrund seiner benutzerfreundlichen Oberfläche als beste Börsenanalyse-App aus, intuitive Navigation, und umfassende Funktionen. Anleger können problemlos auf Analysetools zugreifen, Diagramme, Berichte, und Portfolios für unterwegs, jederzeit fundierte Entscheidungen treffen, überall.

4.2 Beste Website für Börsenanalysen

Die Website von Simply Wall St ergänzt die App, Bereitstellung einer nahtlosen Benutzererfahrung. Die Website bietet eine ausführliche Analyse, Bildungsressourcen, und eine von der Community betriebene Plattform, auf der Anleger Erkenntnisse und Meinungen austauschen können, Etablierung als Anlaufstelle für Börsenanalysen.

Simply Wall St ist die ultimative Anlaufstelle für Anleger, die umfassende Analyse- und Prognosetools für den Aktienmarkt suchen. Mit seiner perfekten Balance zwischen Einfachheit und umfassender Analyse, Simply Wall St bietet ein unvergleichliches Benutzererlebnis. Ob über die benutzerfreundliche App oder die intuitive Website, Anleger können auf detaillierte Analysen zugreifen, interaktive Diagramme, vergleichende Erkenntnisse, und Vorhersagetools. Mit umfassender Abdeckung globaler Märkte, Simply Wall St ermöglicht Anlegern, fundierte Entscheidungen zu treffen, Maximieren Sie potenzielle Renditen, und navigieren Sie mit Zuversicht durch die Komplexität des Aktienmarktes.

Entdecken Sie die Kraft von Simply Wall St: Stärkung der Anleger durch fundierte Entscheidungsfindung

Simply Wall St ist ein leistungsstarkes Tool, das Anlegern zahlreiche Vorteile bietet, unabhängig von ihrem Erfahrungsniveau oder Anlagestil. Durch Nutzung der Plattform, Anleger können eine Vielzahl von Vorteilen nutzen, die ihnen dabei helfen können, fundierte Entscheidungen zu treffen und ihre Anlageportfolios zu optimieren.

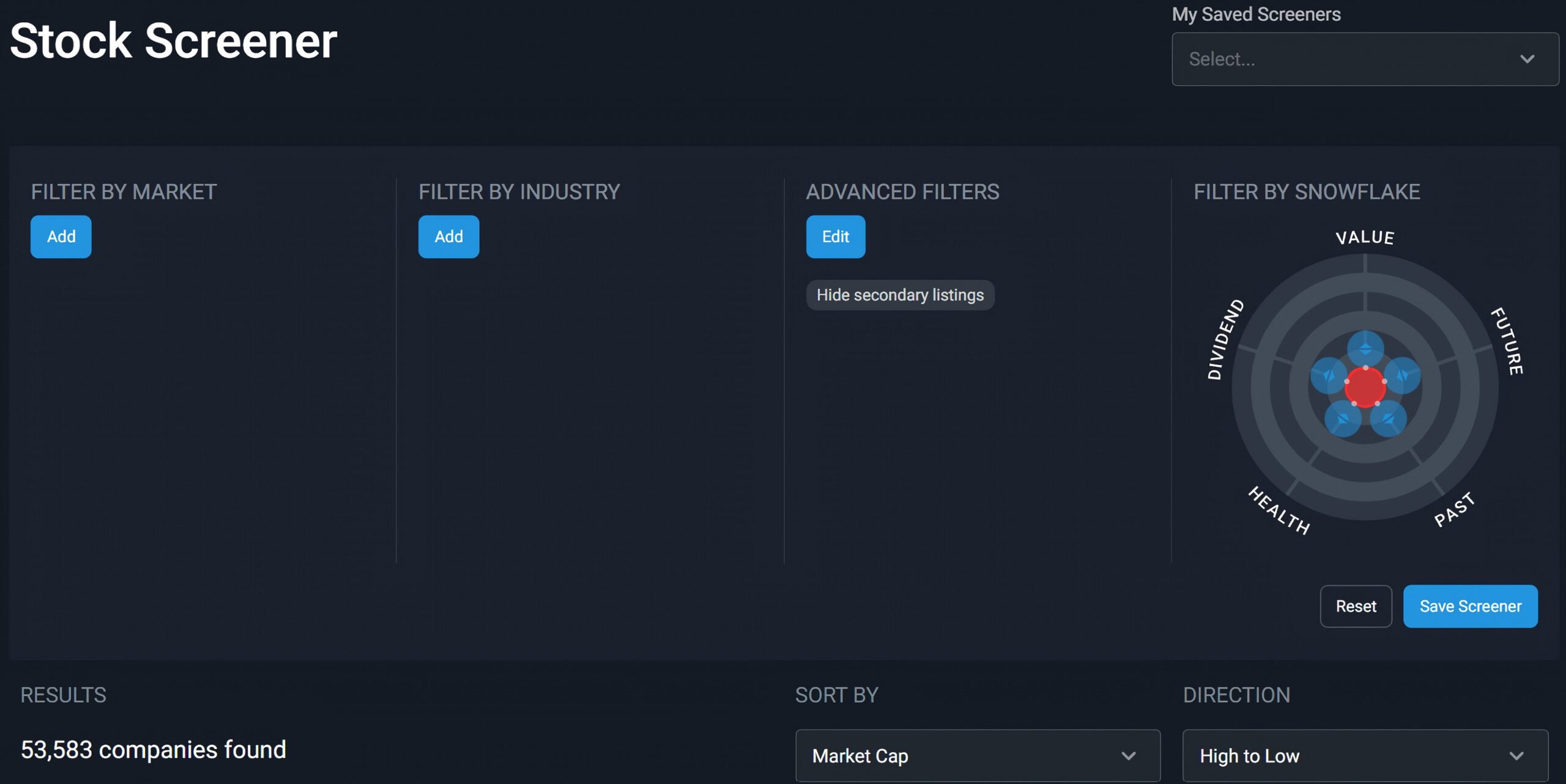

Neue Aktien entdecken: Benutzerdefinierte Filter und kuratierte Listen

Einer der Hauptvorteile von Simply Wall St ist die Möglichkeit, Benutzern dabei zu helfen, neue Aktien zu entdecken, die ihren spezifischen Kriterien und Vorlieben entsprechen. Die Plattform bietet einen robusten Aktien-Screener, der es Anlegern ermöglicht, Aktien anhand verschiedener Parameter zu filtern, inklusive Markt, Sektor, Größe, Stil, Dividendenrendite, Wachstumsrate, Rentabilität, und Bewertung, unter anderem. Mit dieser Funktion können Anleger ihre Suche eingrenzen und potenzielle Investitionsmöglichkeiten identifizieren, die ihren individuellen Anforderungen entsprechen. Darüber hinaus, Simply Wall St bietet kuratierte Aktienlisten zu verschiedenen Themen, wie zum Beispiel unterbewertete Aktien, wachstumsstarke Aktien, hochwertige Aktien, und dividendenstarke Aktien. Diese Funktion hilft Anlegern dabei, Aktien aufzudecken, die sie sonst möglicherweise übersehen hätten.

Ganzheitliche Bewertung: Stärken und Schwächen mit dem Snowflake-Modell aufdecken

Ein weiterer wesentlicher Vorteil von Simply Wall St ist die Möglichkeit, objektive und ganzheitliche Aktienbewertungen zu ermöglichen. Die Plattform verwendet eine visuelle Darstellung, die als Schneeflockenmodell bekannt ist, Dies bietet einen prägnanten Überblick über die Stärken und Schwächen einer Aktie. Durch einen Blick auf das Schneeflockenmodell, Anleger können wichtige Aspekte der Fundamentaldaten einer Aktie schnell beurteilen. Zusätzlich, Benutzer können tiefer in die Analyse jedes Kriteriums eintauchen und verstehen, wie sie zum inneren Wert der Aktie beitragen. Außerdem, Mit Simply Wall St können Anleger die Bewertung einer Aktie mit ihren historischen und Branchendurchschnitten vergleichen, sowie die zukünftigen Cashflow-Prognosen bewerten. Dieser umfassende Bewertungsansatz ermöglicht es Anlegern, fundierte Entscheidungen auf der Grundlage eines umfassenden Verständnisses des Potenzials einer Aktie zu treffen.

Überwachung und Optimierung von Portfolios: Einblicke in die Leistungsverfolgung und Diversifizierung

Die Überwachung der Portfolio-Performance und die Sicherstellung der Diversifizierung sind weitere Bereiche, in denen sich Simply Wall St auszeichnet. Anleger können auf der Plattform mehrere Portfolios erstellen und wichtige Leistungskennzahlen verfolgen, inklusive Retouren, risikoadjustierte Renditen, Volatilität, und Dividendenerträge, unter anderem. Mit dieser Funktion haben Anleger einen klaren Überblick über die Performance ihres Portfolios und können bei Bedarf datengesteuerte Anpassungen vornehmen. Zusätzlich, Simply Wall St bietet Einblicke in die Portfoliodiversifizierung, Dadurch können Anleger ihr Engagement in verschiedenen Sektoren bewerten, Geographien, Größen, Stile, und mehr. Indem Sie Einblick in die Portfoliodiversifizierung gewinnen, Anleger können Risiken mindern und ihre Allokationsstrategien optimieren. Außerdem, Die Plattform bietet personalisierte Empfehlungen, die auf individuelle Ziele und Risikotoleranz zugeschnitten sind, Bereitstellung wertvoller Beratung zur Portfolioerweiterung.

Verbesserung der Anlagefähigkeiten: Bildungsressourcen und kollaborative Einblicke

Simply Wall St dient auch als hervorragende Ressource zum Erlernen und Verbessern von Anlagefähigkeiten. Die Plattform bietet Zugang zu Lehrartikeln und Videos, die verschiedene Anlagekonzepte und -strategien erläutern. Ob ein Investor ein Anfänger oder eine erfahrene Person ist, Diese Lehrmaterialien können ihr Verständnis der Finanzmärkte vertiefen und es ihnen ermöglichen, fundiertere Entscheidungen zu treffen. Darüber hinaus, Simply Wall St erleichtert den Wissensaustausch zwischen Anlegern, indem es Einblicke von Experten und anderen Benutzern bietet, die ihre Meinungen und Erfahrungen zu verschiedenen Aktien und Themen teilen. Dieses kollaborative Umfeld fördert das Lernen und ermöglicht es Anlegern, von vielfältigen Perspektiven zu profitieren.

Simply Wall St bietet Anlegern eine Vielzahl von Vorteilen. Von der Entdeckung neuer Aktien, die bestimmte Kriterien erfüllen, bis hin zur ganzheitlichen und objektiven Bewertung von Aktien, Die Plattform ermöglicht es Anlegern, fundierte Entscheidungen zu treffen. Zusätzlich, Simply Wall St hilft bei der Überwachung der Portfolioleistung und Diversifizierung, Gewährleistung optimaler Allokationsstrategien. Schließlich, Die Plattform dient durch ihre Lehrmaterialien und Community-gesteuerten Erkenntnisse als wertvolle Ressource zum Erlernen und Verbessern von Anlagekompetenzen. Durch die Nutzung der Vorteile von Simply Wall St, Anleger können ihre Anlagestrategien verbessern und sich um die Erreichung ihrer finanziellen Ziele bemühen.

Einfach Wall-Street-Kosten

Preispläne für den Zugang zu umfassenden Börsenanalysen

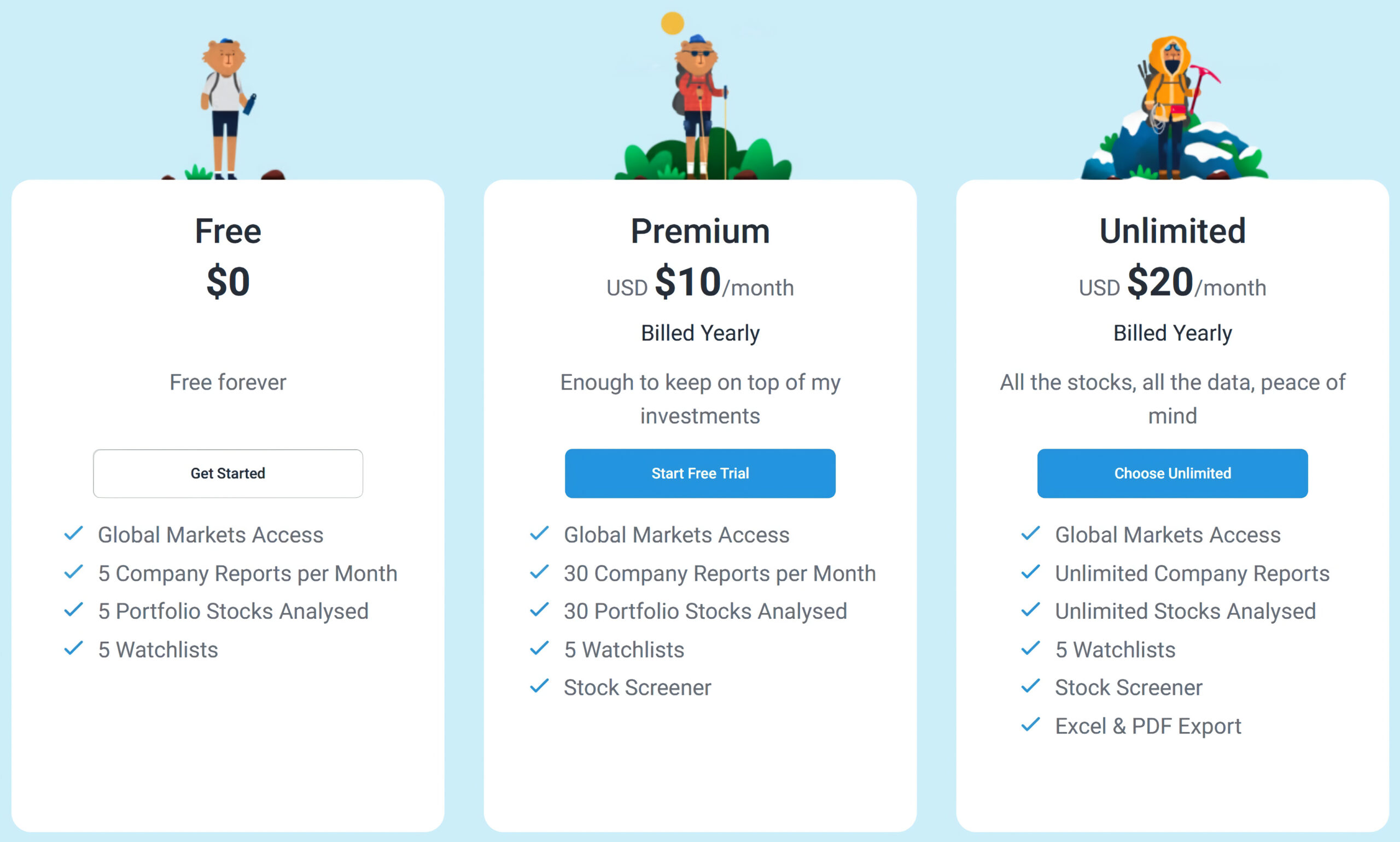

Simply Wall Street bietet Benutzern die Flexibilität, zwischen einem kostenlosen Plan und einem Premium-Plan zu wählen, je nach Bedarf für den Zugriff auf umfassende Börsenanalysen.

Kostenloser Plan: Der kostenlose Plan bietet Zugriff auf bis zu 10 Unternehmensanalysen pro Monat, So können Benutzer Einblicke in bestimmte Aktien gewinnen. Zusätzlich, Benutzer können ein Portfolio mit bis zu erstellen 10 Bestände, Ermöglicht ein grundlegendes Portfoliomanagement.

Premium-Plan: Für Benutzer, die uneingeschränkten Zugriff auf alle Funktionen und Inhalte wünschen, Der Premium-Plan ist zum Preis von erhältlich $9 pro Monat bzw $89 pro Jahr. Mit diesem Plan, Anleger können eine große Auswahl an Aktien erkunden und fortschrittliche Tools nutzen, um ihre Anlageentscheidungen zu verbessern.

14-Kostenlose Testversion für einen Tag: Simply Wall St bietet außerdem eine 14-tägige kostenlose Testversion für den Premium-Plan an. In diesem Testzeitraum können Benutzer den gesamten Funktionsumfang testen und die Eignung der Plattform für ihre Investitionsanforderungen beurteilen, bevor sie sich für ein Abonnement entscheiden.

Egal, ob Sie sich für den kostenlosen Plan für eingeschränkten Zugriff entscheiden oder sich für den Premium-Plan entscheiden, um das volle Potenzial der Plattform auszuschöpfen, Simply Wall St bietet eine erschwingliche Lösung für Anleger, die eine detaillierte Börsenanalyse suchen.

Funktionen des Börsenanalysedienstes – Einfach Wall St

Preisverlauf und wöchentliche Volatilität

Simply Wall St bietet Benutzern Zugriff auf die historischen Aktienkursdaten und die wöchentliche Volatilität eines Unternehmens. Mit dieser Funktion können Anleger die Kursschwankungen und Veränderungen einer Aktie im Laufe der Zeit überwachen, liefert wertvolle Einblicke in seine Leistung.

Gewinn- und Verlustrechnung

Die Plattform bietet eine detaillierte Analyse der Gewinn- und Verlustrechnung eines Unternehmens. Dazu gehören Informationen über den Umsatz des Unternehmens, Betriebskosten, und Nettoeinkommen. Durch die Untersuchung dieser Finanzkennzahlen, Benutzer können ein tieferes Verständnis für die finanzielle Gesundheit und Rentabilität des Unternehmens gewinnen.

Rückkehr vs. Markt

Mit Simply Wall St können Benutzer die Rendite eines Unternehmens mit der des gesamten Aktienmarktes vergleichen. Mithilfe dieser Funktion können Anleger beurteilen, wie gut sich ein Unternehmen im Vergleich zum Gesamtmarkt entwickelt hat, Bereitstellung von Einblicken in seine Wettbewerbsposition und Marktleistung.

Dividendenhistorie

Simply Wall St bietet eine Aufzeichnung der Dividendenhistorie eines Unternehmens. Diese Funktion ist besonders nützlich für einkommensorientierte Anleger, die auf konstante Dividendenzahlungen angewiesen sind. Durch Zugriff auf die Dividendenhistorie eines Unternehmens, Benutzer können die Erfolgsbilanz bei der Ausschüttung von Dividenden bewerten und fundierte Entscheidungen hinsichtlich der Dividendeninvestition treffen.

Rückkehr vs. Industrie

Mit Simply Wall St können Benutzer die Rendite eines Unternehmens mit der seiner Branchenkollegen vergleichen. Mit dieser Funktion können Anleger beurteilen, wie gut ein Unternehmen in seinem spezifischen Industriesektor abschneidet. Das Verständnis der relativen Leistung eines Unternehmens im Vergleich zu seinen Branchenkollegen kann wertvolle Erkenntnisse über seine Wettbewerbsposition und sein Wachstumspotenzial liefern.

Stabiler Aktienkurs

Simply Wall St unterstützt Benutzer bei der Identifizierung von Unternehmen mit einem stabilen Aktienkurs. Diese Funktion hilft Anlegern, die eine stabilere und vorhersehbarere Anlage bevorzugen, indem sie Unternehmen hervorhebt, die im Laufe der Zeit einen konstanten Aktienkurs gezeigt haben.

Tage bis zur Dividendenzahlung

Die Plattform bietet Nutzern Informationen zu bevorstehenden Dividenden und der Anzahl der verbleibenden Tage bis zur Auszahlung. Diese Funktion ermöglicht es Dividenden-orientierten Anlegern planen ihre Anlagestrategien und antizipieren Sie bevorstehende Einnahmen aus Dividendenzahlungen.

Cloud-Services und Kundenservice-Analyse

Simply Wall St bietet detaillierte Unternehmensanalysen über verschiedene Branchen hinweg, einschließlich Cloud-Services und Kundenservice. Diese Funktion bietet Benutzern Einblicke in die Finanzkennzahlen, Wachstumspotenzial, und Wettbewerbslandschaft der in diesen Sektoren tätigen Unternehmen. Anleger können diese Informationen nutzen, um fundierte Investitionsentscheidungen in bestimmten Branchen zu treffen.

Streaming-Service-Analyse

Simply Wall St bietet Analysen, die speziell auf Streaming-Dienstleister zugeschnitten sind. Diese Funktion bietet Einblicke in die finanzielle Leistung, Schlüsselkennzahlen, und Wachstumsaussichten von Streaming-Dienstleistern. Anleger, die sich für diesen Sektor interessieren, können wertvolle Erkenntnisse für ihre Anlagestrategien gewinnen.

Kapitalrendite

Simply Wall St bietet eine Analyse der Kapitalrendite eines Unternehmens. Mithilfe dieser Kennzahl können Benutzer die Effizienz eines Unternehmens bei der Erzielung von Erträgen aus seinen Kapitalinvestitionen bewerten. Durch die Bewertung der Kapitalrendite eines Unternehmens, Anleger können Unternehmen mit starken Bilanzen und soliden Aktionärsrenditen identifizieren.

Gesamt, Simply Wall St bietet umfassende Funktionen, die es Anlegern ermöglichen, fundierte Entscheidungen zu treffen. Durch Zugriff auf historische Preisdaten, Finanzberichtanalyse, Dividendengeschichte, Branchen- und Marktvergleiche, Stabilitätsbewertungen, und spezialisierte Branchenanalysen, Nutzer können wertvolle Einblicke in Unternehmen und Märkte gewinnen, um ihre Anlagestrategien zu unterstützen.

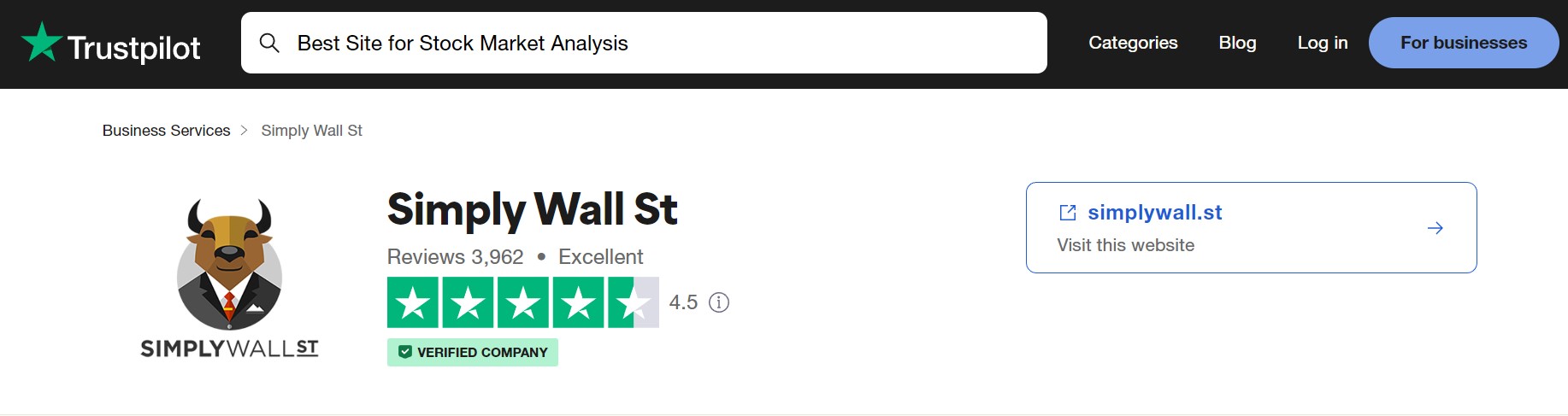

Simply Wall St-Bewertungen: Benutzer loben die Effizienz und die umfassenden Funktionen der Plattform

In diesen Bewertungen auf Trustpilot schwärmen Benutzer von Simply Wall St. Von der schnellen und effektiven Kundenbetreuung bis zur einfachen und prägnanten Präsentation von Informationen, Die Plattform erntet großes Lob. Der Aktien-Screener wird als erstaunliches und benutzerfreundliches Tool gefeiert, Dies erleichtert die Identifizierung gesunder Unternehmen mit Zukunftspotenzial zu einem günstigen Preis. Die App selbst wird für ihre Benutzerfreundlichkeit gelobt, Umfangreiche Datenabdeckung, und Verfügbarkeit für mehrere Märkte. Darüber hinaus, Benutzer schätzen die Fülle an Informationen der Plattform und die hervorragende Unterstützung durch das Kundendienstteam. Simply Wall St überzeugt weiterhin durch seine Effizienz und umfassenden Funktionen, Dies macht es zur ersten Wahl für Anleger.

TrustPilot-Kundenrezensionen zu Simply Wall St

- „Ich hätte nicht gedacht, dass ich so schnell und so effektiv eine Antwort bekommen würde. Ich habe sie um Hilfe gebeten, Innerhalb von etwa einer Stunde erhielt ich die Antwort und konnte mein Problem beheben. Tolle Plattform!!“

Diese Bewertung unterstreicht den hervorragenden Kundensupport von Simply Wall St. Der Benutzer war angenehm überrascht von der schnellen und effektiven Reaktion, die er bei der Suche nach Hilfe erhielt. Sie schätzten die Fähigkeit der Plattform, ihr Problem umgehend zu lösen, Dies demonstriert die Service- und Supportqualität von Simply Wall St.

- „Einfach Wall Street ist einfach“

Der Rezensent lobt Simply Wall St für die klare und prägnante Darstellung der Informationen. Sie schätzen, wie die Plattform den Prozess vereinfacht, einen umfassenden Überblick über eine Aktie zu erhalten, Dies dient als wertvoller Ausgangspunkt für weitere Forschungen. Der Rezensent erwähnt, dass er seine Beobachtungsliste mit Daten von anderen Plattformen abgleicht, aufgrund der Zeitersparnis und der Fähigkeit der Plattform, eine solide Informationsgrundlage bereitzustellen, jedoch lieber mit Simply Wall St beginnt.

- „Der Aktien-Screener ist fantastisch und das benutzerfreundlichste Anlagetool, das ich je verwendet habe. Es hat mir das Leben viel leichter gemacht, gesunde, zukunftsfähige Unternehmen zu einem guten Preis zu finden. Das einzige Unternehmen, das ich mit einer einfachen grafischen Benutzeroberfläche für das Screening gesehen habe.“

Diese Bewertung unterstreicht die außergewöhnliche Qualität des Aktien-Screeners von Simply Wall St. Der Benutzer lobt das Tool für seine Benutzerfreundlichkeit und beschreibt es als das beeindruckendste Anlagetool, das er je kennengelernt hat. Sie betonen, wie der Screener den Prozess der Identifizierung gesunder Unternehmen mit Zukunftspotenzial zu einem angemessenen Preis vereinfacht. Der Rezensent erwähnt ausdrücklich die einzigartige grafische Benutzeroberfläche der Plattform für das Screening, Sie weisen darauf hin, dass sie kein anderes Unternehmen mit einer ähnlichen Funktion kennengelernt haben.

- „Einfache App und riesige Datenmengen“

Der Rezensent teilt seine positiven Erfahrungen mit der App von Simply Wall St. Sie schätzen die Benutzerfreundlichkeit, Ich beschreibe es als großartig und einfach zu bedienen, ohne Komplikationen. Der Nutzer erkennt an, dass die App Zugriff auf Daten nicht nur für den US-amerikanischen Markt, sondern auch für verschiedene andere Märkte bietet, ihre Vorlieben zu treffen. Als wertvollen Aspekt des App-Angebots nennen sie die Verfügbarkeit umfassender Börseninformationen und Nachrichten.

- „Tolle App-Infos und Leute“

Der Rezensent drückt seine Zufriedenheit mit der App von Simply Wall St aus, Hervorheben der Fülle an Informationen, die es bietet. Sie erwähnen insbesondere die große Datenmenge, die über die App verfügbar ist, die der Nutzer für seine Anlageentscheidungen als wertvoll erachtet. Zusätzlich, Der Rezensent lobt den Kundenservice, Beachten Sie, dass das Team umgehend reagiert, professionell, und bietet hervorragende Unterstützung und Antworten. Der Rezensent drückt abschließend seine Wertschätzung für die App und die Unterstützung aus, die er vom Team von Simply Wall St erhalten hat.

Diese TrustPilot Bewertungen belegen die positiven Erfahrungen und die Zufriedenheit der Benutzer mit Simply Wall St. Der effektive Kundensupport der Plattform, Einfachheit bei der Präsentation von Informationen, benutzerfreundlicher Aktien-Screener, Umfangreiche Datenabdeckung, und reaktionsschneller Kundenservice sind einige der Aspekte, die Benutzer schätzen und schätzen.

Möglich Tisch Dies zeigt den Prozentsatz der Benutzer, die jeden Dienst von Simply Wall St nutzen

| Service | Prozentsatz der Benutzer |

| Aktien-Screener | 25% |

| Aktienanalyse | 35% |

| Aktienvergleich | 10% |

| Lagerlisten | 15% |

| Portfolio Tracker | 20% |

| Portfolio-Optimierer | 10% |

| Bildungsinhalte | 15% |

| Einblicke | 10% |

Notiz: Prozentangaben sind Schätzungen und stimmen nicht überein 100% da einige Benutzer möglicherweise mehr als einen Dienst nutzen.

Fragen und Antworten zum Börsenanalysetool Simply Wall St

Q: Was ist Simply Wall St? A: Simply Wall St ist ein Dienst, der eine umfassende und leicht verständliche Analyse von Aktien auf der Grundlage ihrer finanziellen Leistung bietet, Bewertung, Dividenden, zukünftiges Wachstumspotenzial, und Risiko. Es bietet interaktive Diagramme, Infografiken, Berichte, und Portfolios, um Anlegern dabei zu helfen, ihre Investitionen zu visualisieren und zu verfolgen.

Q: Wer gründete Simply Wall St? A: Simply Wall St wurde im Jahr gegründet 2014 von Al Bentley und Nick van den Berg, zwei ehemalige Software-Ingenieure, deren Ziel es war, eine bessere Möglichkeit zur Aktienrecherche zu schaffen.

Q: Was ist das Alleinstellungsmerkmal des Schneeflockenmodells von Simply Wall St?? A: Das Schneeflockenmodell von Simply Wall St fasst die wichtigsten Aspekte einer Aktie in einer einfachen Grafik zusammen. Die Schneeflocke zeigt, wie eine Aktie bei fünf Kriterien abschneidet: Wert, Zukunft, Vergangenheit, Gesundheit, und Einkommen. Je näher die Form einem perfekten Kreis kommt, desto ausgewogener ist die Aktie.

Q: Welche Art von Analyse bietet Simply Wall St für Aktien an?? A: Simply Wall St bietet eine detaillierte Analyse verschiedener Kriterien für Aktien, einschließlich ihrer finanziellen Leistung, Bewertung, Konsens der Analysten, Insiderhandel, Eigentümerstruktur, Ertragsqualität, und mehr. Außerdem können Benutzer Aktien mit denen ihrer Branchenkollegen oder dem Marktdurchschnitt vergleichen.

Q: Wie viele Aktien und Märkte deckt Simply Wall St ab?? A: Simply Wall St deckt ab 75,000 Bestände quer 91 Märkte weltweit. Diese breite Abdeckung ermöglicht es Anlegern, Chancen in jedem Sektor oder jeder Region zu finden, an der sie interessiert sind.

Q: Bietet Simply Wall St Tools für das Portfoliomanagement?? A: Ja, Simply Wall St bietet Tools für das Portfoliomanagement. Benutzer können mehrere Portfolios erstellen und ihre Renditen verfolgen, risikoadjustierte Renditen, Volatilität, Dividendenerträge, und mehr. Die Plattform bietet außerdem personalisierte Empfehlungen, die Benutzern dabei helfen, ihre Portfolios basierend auf ihren Zielen und ihrer Risikotoleranz zu verbessern.

Q: Können Benutzer auf Bildungsressourcen auf Simply Wall St. zugreifen?? A: Ja, Benutzer können auf Lehrartikel und Videos auf Simply Wall St zugreifen. Diese Ressourcen erläutern verschiedene Anlagekonzepte und -strategien, Bereitstellung von Möglichkeiten für Benutzer, ihre Investitionsfähigkeiten zu erlernen und zu verbessern.

Q: Ist Simply Wall St auf die Bereitstellung von Analysen für einen bestimmten Markt oder Sektor ausgerichtet?? A: NEIN, Simply Wall St deckt eine breite Palette von Aktien aus verschiedenen Sektoren und Märkten weltweit ab. Ziel ist es, das Investieren für jedermann zugänglich und angenehm zu machen, unabhängig von ihrem bevorzugten Markt oder Sektor.

Q: Was sind einige der Hauptmerkmale von Simply Wall St? A: Simply Wall St bietet Funktionen wie Preisverlauf und wöchentliche Volatilitätsverfolgung, Analyse der Gewinn- und Verlustrechnung, Vergleich der Rendite eines Unternehmens mit dem Markt oder der Branche, Aufzeichnungen zur Dividendenhistorie, Identifizierung von Unternehmen mit stabilen Aktienkursen, Informationen zur bevorstehenden Dividendenzahlung, Analyse von Cloud-Diensten und Kundendienstunternehmen, Analyse von Streamingdienst-Unternehmen, und Analyse der Kapitalrendite zur Identifizierung von Unternehmen mit hervorragenden Bilanzen und Aktionärsrenditen.

Hier ist eine mögliche Tabelle mit allen Dienstleistungen von Simply Wall Street

| Service | Beschreibung |

|---|---|

| Aktien-Screener | Ein Tool, mit dem Benutzer Aktien nach Markt filtern können, Sektor, Größe, Stil, Dividendenrendite, Wachstumsrate, Rentabilität, Wertermittlung und mehr. |

| Aktienanalyse | Ein Service, der eine umfassende und leicht verständliche Analyse von Aktien basierend auf ihrer finanziellen Leistung bietet, Bewertung, Dividenden, zukünftiges Wachstumspotenzial und Risiko. Es bietet außerdem ein einzigartiges Schneeflockenmodell, das die wichtigsten Aspekte einer Aktie in einer einfachen Grafik zusammenfasst. |

| Aktienvergleich | Eine Funktion, die es Benutzern ermöglicht, Aktien mit denen ihrer Branchenkollegen oder dem Marktdurchschnitt zu vergleichen, um zu sehen, wie sie abschneiden. |

| Lagerlisten | Ein Dienst, der kuratierte Aktienlisten basierend auf Themen wie „unterbewertet“ anbietet, hohes Wachstum, hohe Qualität, hohe Dividende und mehr. |

| Portfolio Tracker | Ein Tool, mit dem Benutzer mehrere Portfolios erstellen und ihre Renditen verfolgen können, risikoadjustierte Renditen, Volatilität, Dividendenerträge und mehr. Es zeigt auch, wie das Portfolio nach Sektoren diversifiziert ist, Geographie, Größe, Stil und mehr. |

| Portfolio-Optimierer | Eine Funktion, die personalisierte Empfehlungen zur Verbesserung des Portfolios basierend auf den Zielen und der Risikotoleranz des Benutzers bietet. |

| Bildungsinhalte | Ein Dienst, der lehrreiche Artikel und Videos bereitstellt, die verschiedene Anlagekonzepte und -strategien erklären. |

| Einblicke | Ein Service, der Einblicke von Experten und anderen Anlegern bietet, die ihre Meinungen und Erfahrungen zu verschiedenen Aktien und Themen teilen. |

Einfach Wall St: Eine vertrauenswürdige Plattform für fundierte Anlageentscheidungen

Nach gründlicher Prüfung der Funktionen von Simply Wall St, Vorteile, Preisgestaltung, und Kundenrezensionen, Es ist offensichtlich, dass die Plattform eine legitime und zuverlässige Ressource für Privatanleger ist. Mit seinen umfassenden Aktienanalysetools und ausführlichen Unternehmensberichten, Simply Wall St versorgt Anleger mit wertvollen Erkenntnissen, um fundierte Entscheidungen auf der Grundlage fundamentaler Statistiken zu treffen, Wachstumspotenzial, und andere wichtige Datenpunkte.

Die Verfügbarkeit eines Premium-Plans erweitert das Angebot der Plattform, den Nutzern Zugriff auf umfangreichere Unternehmensanalysen zu gewähren, Tools zur Aktienanalyse, Anlageideen, und Beratung durch erfahrene Investoren. Das visuelle Format und die benutzerfreundliche Oberfläche der Plattform machen sie für Anleger aller Ebenen zugänglich, So stellen wir sicher, dass sich auch Anfänger sicher an der Börse zurechtfinden können.

Darüber hinaus, Der Ruf von Simply Wall St wird durch seinen hohen TrustScore von untermauert 4.5 von 5 und eine Vielzahl positiver Kundenrezensionen. Diese Faktoren belegen die Legitimität der Plattform, Wirksamkeit, und Engagement, seinen Nutzern wertvolle finanzielle Einblicke zu bieten.

Abschließend, Simply Wall St ist eine vertrauenswürdige und wertvolle Plattform für Privatanleger, die fundierte Anlageentscheidungen treffen möchten. Seine umfassenden Funktionen, benutzerfreundliche Oberfläche, und das positive Kundenfeedback machen es zu einer ausgezeichneten Wahl sowohl für Anfänger als auch für erfahrene Anleger. Wenn Sie ein tieferes Verständnis des Aktienmarktes erlangen und fundiertere Anlageentscheidungen treffen möchten, Wir empfehlen dringend, Simply Wall St. in Betracht zu ziehen.

Beginnen Sie noch heute Ihre Investitionsreise Klicken Sie hier

Tools zur Börsenanalyse – Frei