A Service for Stock Market Analysis

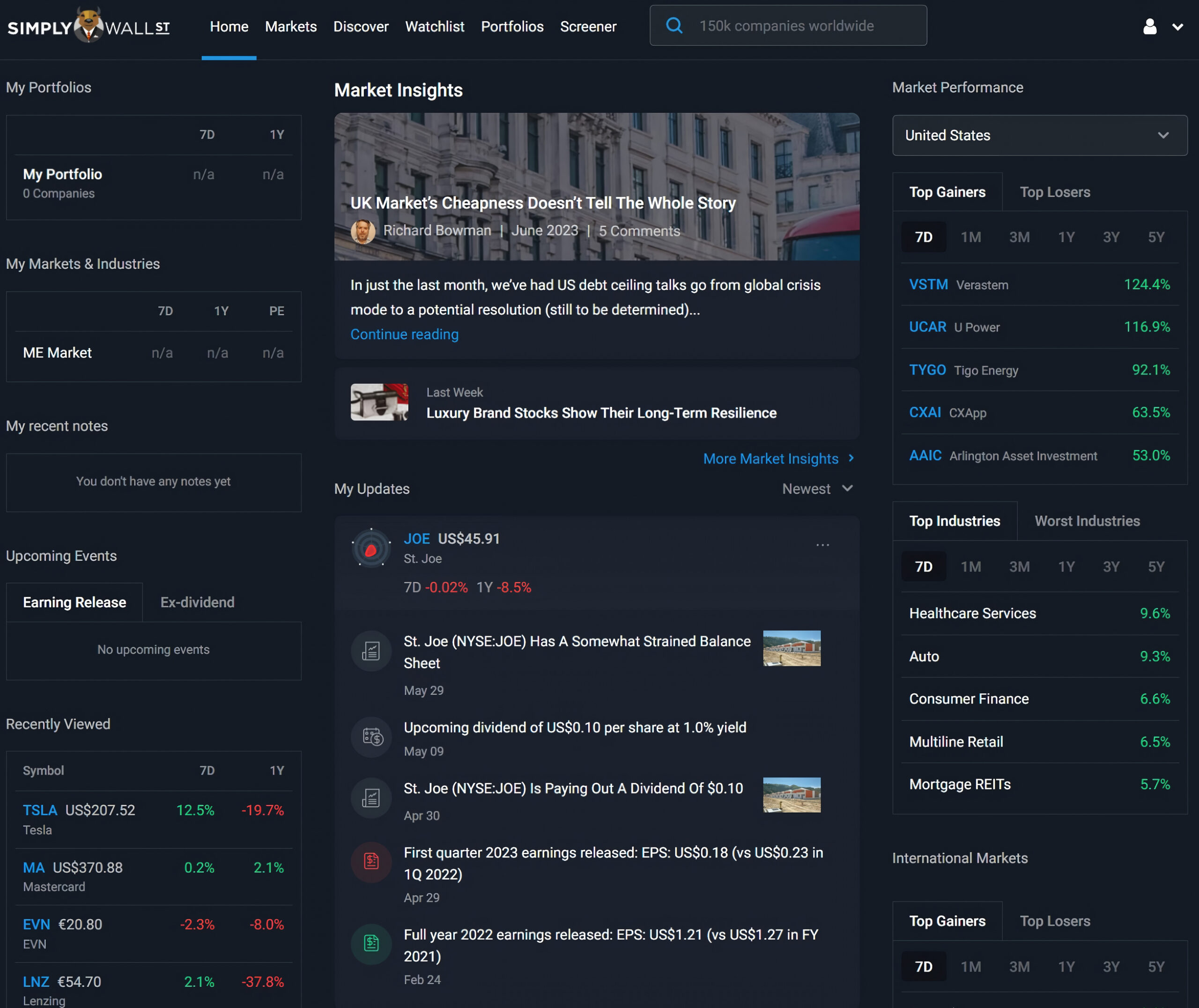

Investors seeking comprehensive stock market analysis and tools today have a valuable resource in Simply Wall St. With a focus on the US stock market analysis and prediction, Simply Wall St provides in-depth insights into stocks based on their financial performance, valuation, dividends, future growth potential, and risk. It offers an intuitive interface, interactive charts, infographics, reports, and portfolio management features, making it the best stock market analysis app and site available.

1. Understanding Simply Wall St

1.1 The Need for Perfect Stock Market Analysis

Simply Wall St was founded in 2014 by Al Bentley and Nick van den Berg, former software engineers who recognized the need for a more efficient and user-friendly approach to stock market analysis. Their vision was to create a service that would provide the perfect balance between simplicity and comprehensive analysis.

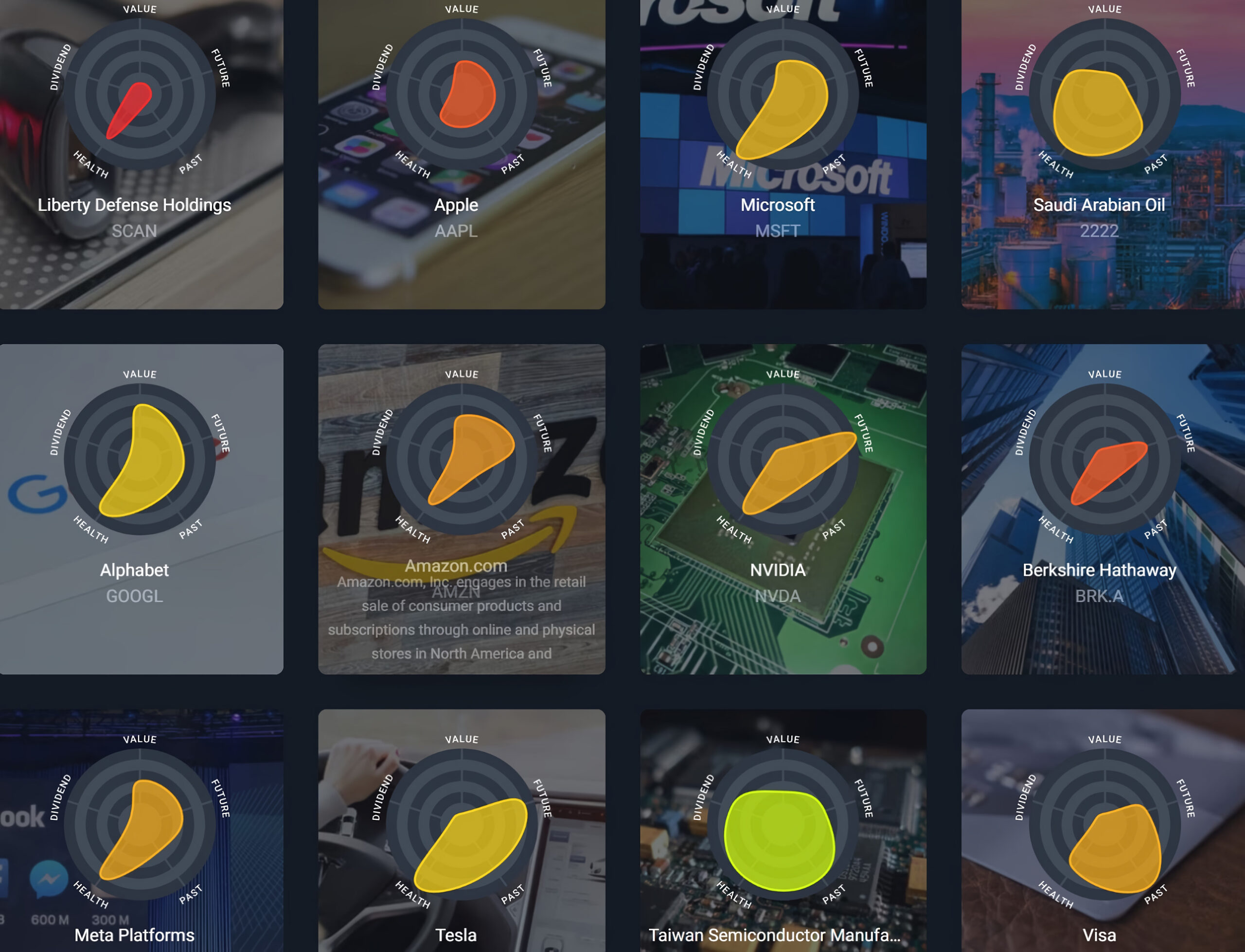

1.2 The Unique Snowflake Model

At the heart of Simply Wall St’s analysis is the innovative snowflake model. This model condenses the key aspects of a stock into a visually appealing graphic. By assessing five criteria—value, future potential, past performance, financial health, and income—the snowflake model provides a quick and intuitive snapshot of a stock’s balance and potential.

2. Comprehensive Analysis Tools

2.1 Detailed Criterion Analysis

Simply Wall St excels in providing detailed analysis of each criterion in the snowflake model. Through thorough examination of value, future potential, past performance, financial health indicators, and income generation, investors can gain a comprehensive understanding of a stock’s strengths and weaknesses.

2.2 Comparative Analysis Tools

Investors can leverage Simply Wall St’s tools to compare stocks with their industry peers or the market average. This functionality allows for a contextual evaluation of a stock’s performance relative to its competitors, aiding decision-making processes.

3. Extensive Coverage and Predictive Insights

3.1 Wide Market Reach

Simply Wall St boasts an impressive coverage of over 75,000 stocks across 91 markets worldwide. This expansive market reach ensures that investors can find opportunities in any sector or region, making it an indispensable resource for global market analysis.

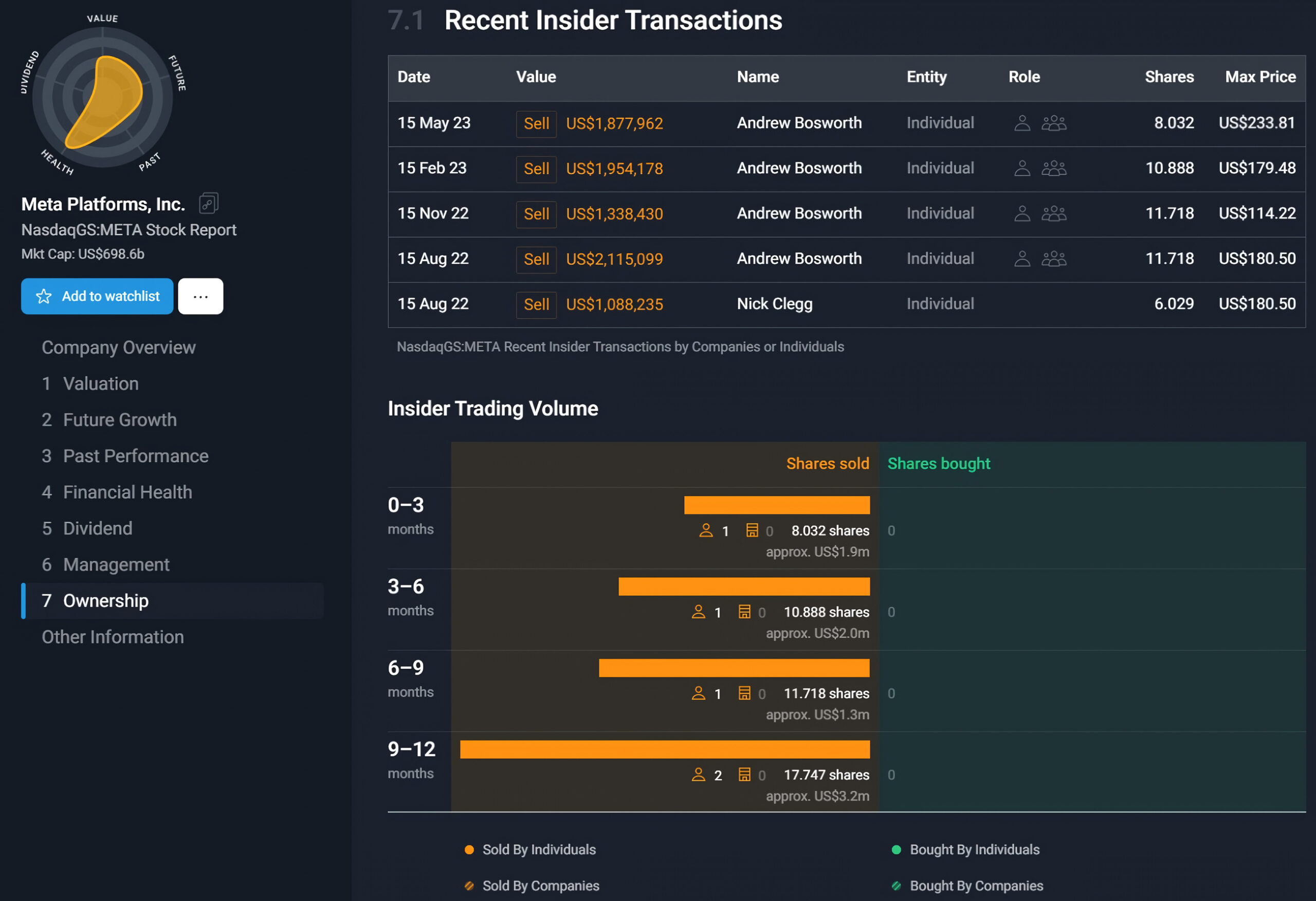

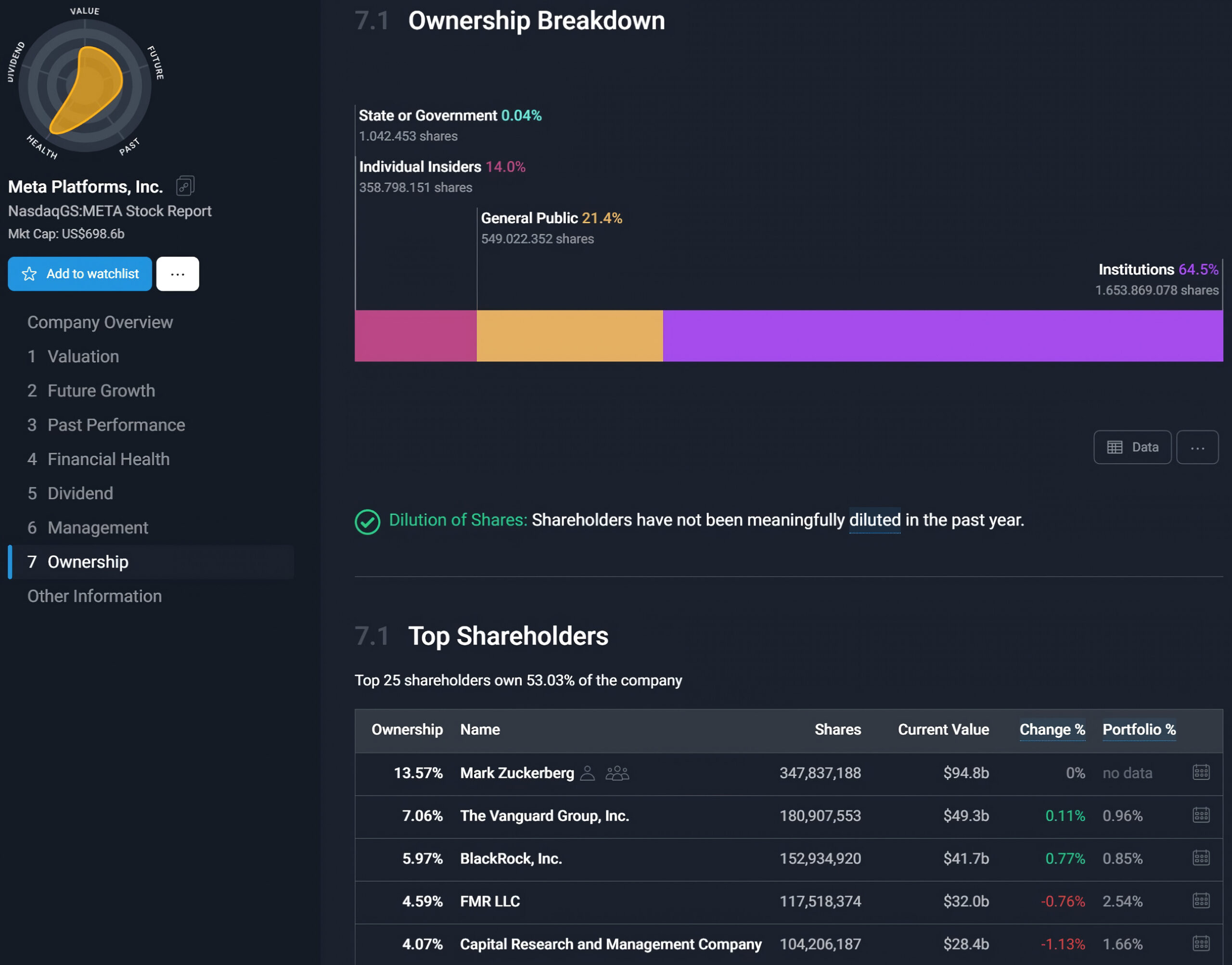

3.2 Accessible Predictive Insights

To assist investors in making informed decisions, Simply Wall St provides access to analyst consensus, insider trading information, ownership structure, earnings quality assessments, and more. These predictive insights help investors anticipate market trends and potential risks.

4. Intuitive App and User-Friendly Site

4.1 Best Stock Market Analysis App

Simply Wall St stands out as the best stock market analysis app due to its user-friendly interface, intuitive navigation, and comprehensive features. Investors can easily access analysis tools, charts, reports, and portfolios on the go, making informed decisions anytime, anywhere.

4.2 Best Site for Stock Market Analysis

Simply Wall St’s website complements its app, providing a seamless user experience. The site offers in-depth analysis, educational resources, and a community-driven platform where investors can exchange insights and opinions, establishing it as the go-to site for stock market analysis.

Simply Wall St is the ultimate destination for investors seeking comprehensive stock market analysis and prediction tools. With its perfect balance between simplicity and comprehensive analysis, Simply Wall St offers an unparalleled user experience. Whether accessed through its user-friendly app or intuitive website, investors can access in-depth analysis, interactive charts, comparative insights, and predictive tools. With extensive coverage of global markets, Simply Wall St empowers investors to make informed decisions, maximize potential returns, and navigate the complexities of the stock market with confidence.

Unlocking the Power of Simply Wall St: Empowering Investors with Informed Decision-Making

Simply Wall St is a powerful tool that provides numerous benefits to investors, regardless of their experience level or investment style. By utilizing the platform, investors can unlock a wide array of advantages that can aid in making informed decisions and optimizing their investment portfolios.

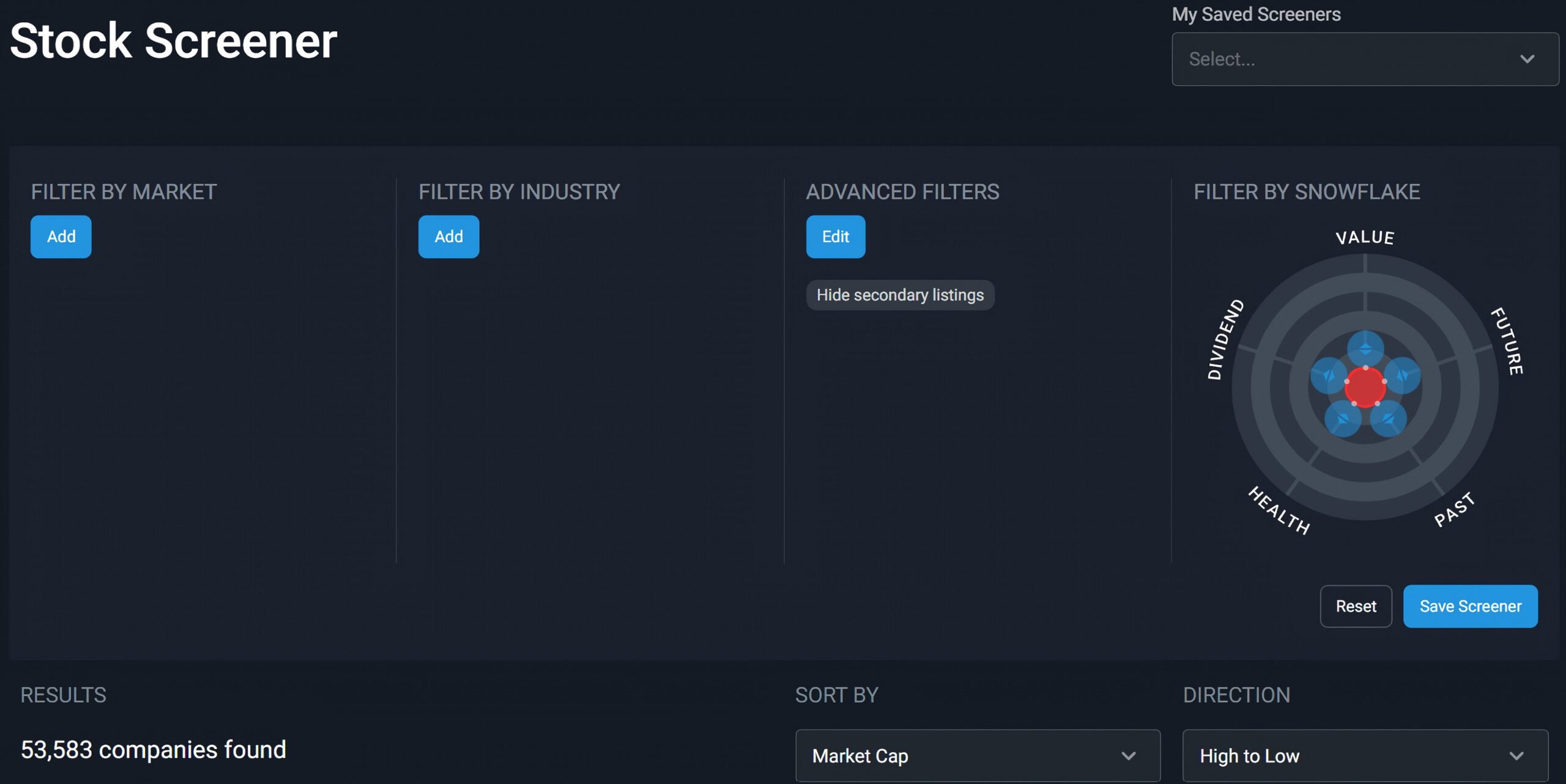

Discovering New Stocks: Customized Filters and Curated Lists

One of the primary benefits of Simply Wall St is its ability to help users discover new stocks that align with their specific criteria and preferences. The platform offers a robust stock screener that enables investors to filter stocks based on various parameters, including market, sector, size, style, dividend yield, growth rate, profitability, and valuation, among others. This feature allows investors to narrow down their search and identify potential investment opportunities that meet their unique requirements. Moreover, Simply Wall St provides curated lists of stocks based on different themes, such as undervalued stocks, high-growth stocks, high-quality stocks, and high-dividend stocks. This feature assists investors in uncovering stocks that they might have otherwise overlooked.

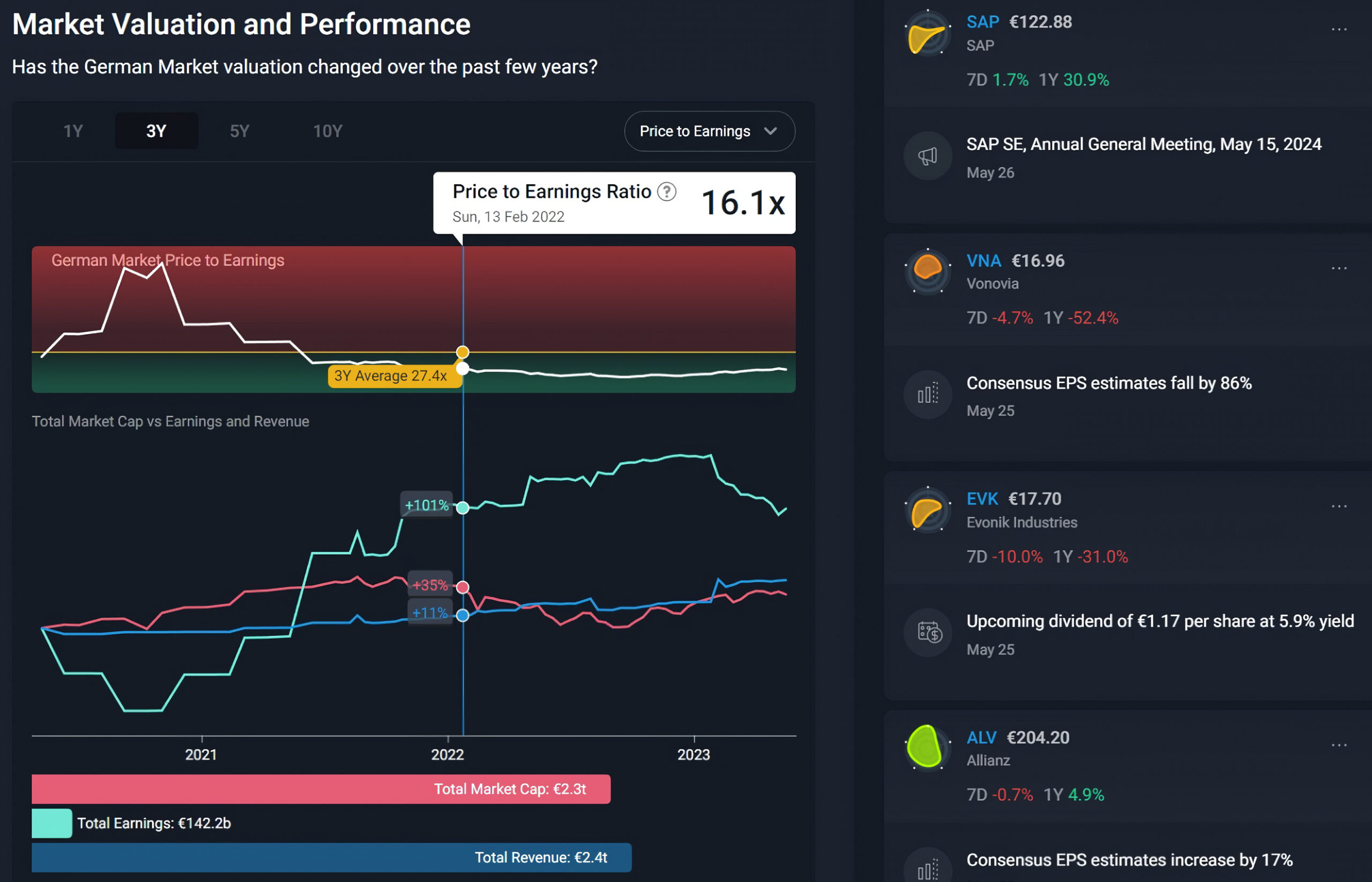

Holistic Evaluation: Unveiling Strengths and Weaknesses with the Snowflake Model

Another significant benefit of Simply Wall St is its ability to facilitate objective and holistic stock evaluations. The platform employs a visual representation known as the snowflake model, which provides a concise overview of a stock’s strengths and weaknesses. By glancing at the snowflake model, investors can quickly assess key aspects of a stock’s fundamentals. Additionally, users can delve deeper into the analysis of each criterion and understand how they contribute to the stock’s intrinsic value. Furthermore, Simply Wall St enables investors to compare a stock’s valuation to its historical and industry averages, as well as evaluate its future cash flow projections. This comprehensive evaluation approach empowers investors to make well-informed decisions based on a thorough understanding of a stock’s potential.

Monitoring and Optimizing Portfolios: Performance Tracking and Diversification Insights

Monitoring portfolio performance and ensuring diversification is another area where Simply Wall St excels. Investors can create multiple portfolios on the platform and track essential performance metrics, including returns, risk-adjusted returns, volatility, and dividend income, among others. This feature allows investors to have a clear overview of their portfolio’s performance and make data-driven adjustments as necessary. Additionally, Simply Wall St provides insights into portfolio diversification, allowing investors to evaluate their exposure across different sectors, geographies, sizes, styles, and more. By gaining visibility into portfolio diversification, investors can mitigate risk and optimize their allocation strategies. Furthermore, the platform offers personalized recommendations tailored to individual goals and risk tolerance, providing invaluable guidance on portfolio enhancement.

Enhancing Investing Skills: Educational Resources and Collaborative Insights

Simply Wall St also serves as an excellent resource for learning and improving investing skills. The platform provides access to educational articles and videos that explain various investing concepts and strategies. Whether an investor is a novice or an experienced individual, these educational materials can deepen their understanding of the financial markets and enable them to make more informed decisions. Moreover, Simply Wall St facilitates knowledge-sharing among investors by offering insights from experts and other users who share their opinions and experiences on different stocks and topics. This collaborative environment promotes learning and allows investors to benefit from a diverse range of perspectives.

Simply Wall St offers a multitude of benefits for investors. From discovering new stocks that match specific criteria to evaluating stocks holistically and objectively, the platform empowers investors to make informed decisions. Additionally, Simply Wall St aids in monitoring portfolio performance and diversification, ensuring optimal allocation strategies. Lastly, the platform serves as a valuable resource for learning and improving investing skills through its educational materials and community-driven insights. By leveraging the advantages provided by Simply Wall St, investors can enhance their investment strategies and strive towards achieving their financial goals.

Simply Wall Street Cost

Pricing Plans for Access to Comprehensive Stock Market Analysis

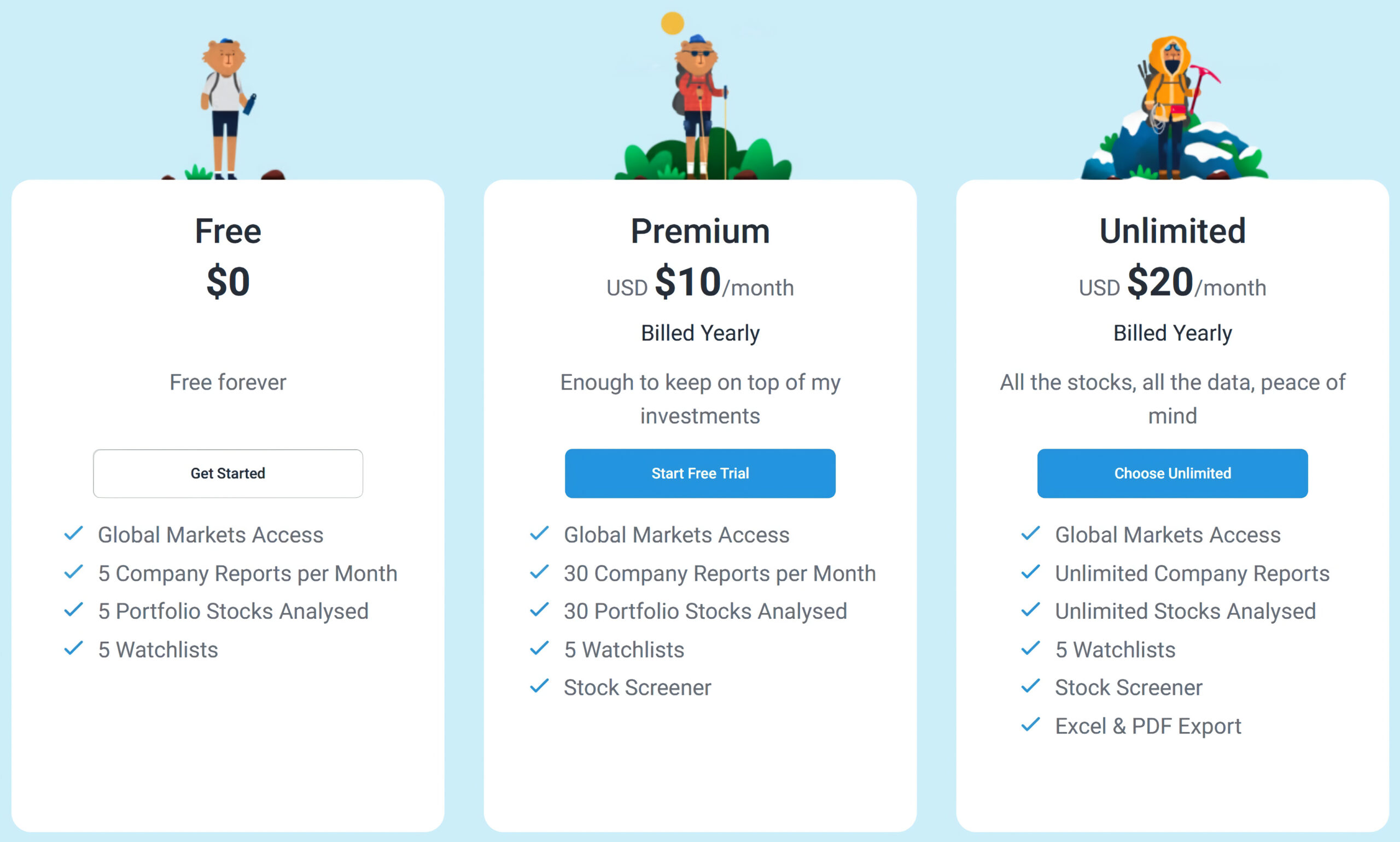

Simply Wall Street offers users the flexibility to choose between a free plan and a premium plan, depending on their needs for accessing comprehensive stock market analysis.

Free Plan: The free plan provides access to up to 10 company analyses per month, allowing users to gather insights on specific stocks. Additionally, users can create one portfolio with up to 10 holdings, enabling basic portfolio management.

Premium Plan: For users seeking unlimited access to all features and content, the premium plan is available at a cost of $9 per month or $89 per year. With this plan, investors can explore a vast range of stocks and utilize advanced tools to enhance their investment decisions.

14-Day Free Trial: Simply Wall St also offers a 14-day free trial for the premium plan. This trial period allows users to experience the full range of features and evaluate the platform’s suitability for their investment needs before committing to a subscription.

Whether you choose the free plan for limited access or opt for the premium plan to unlock the platform’s complete potential, Simply Wall St provides an affordable solution for investors looking for in-depth stock market analysis.

Features of Stock Market Analysis Service – Simply Wall St

Price History and Weekly Volatility

Simply Wall St provides users with access to a company’s historical share price data and weekly volatility. This feature allows investors to monitor the price fluctuations and changes in a stock over time, providing valuable insights into its performance.

Income Statement

The platform offers a detailed analysis of a company’s income statement. This includes information on the company’s revenue, operating expenses, and net income. By examining these financial metrics, users can gain a deeper understanding of the company’s financial health and profitability.

Return vs. Market

Simply Wall St allows users to compare a company’s return with that of the overall stock market. This feature helps investors assess how well a company has performed relative to the broader market, providing insights into its competitive position and market performance.

Dividend History

Simply Wall St provides a record of a company’s dividend history. This feature is particularly useful for income-focused investors who rely on consistent dividend payments. By accessing a company’s dividend history, users can evaluate its track record in distributing dividends and make informed decisions regarding dividend investing.

Return vs. Industry

Simply Wall St enables users to compare a company’s return with that of its industry peers. This feature allows investors to assess how well a company is performing within its specific industry sector. Understanding a company’s relative performance in comparison to its industry peers can provide valuable insights into its competitive position and growth potential.

Stable Share Price

Simply Wall St assists users in identifying companies with a stable share price. This feature helps investors who prefer a more stable and predictable investment by highlighting companies that have demonstrated a consistent share price over time.

Days Until Dividend Pay

The platform provides users with information on upcoming dividends and the number of days remaining until they are paid. This feature allows dividend-focused investors to plan their investment strategies and anticipate upcoming income from dividend payments.

Cloud Services and Customer Service Analysis

Simply Wall St offers detailed company analyses across various industries, including cloud services and customer service. This feature provides users with insights into the financial metrics, growth potential, and competitive landscape of companies operating in these sectors. Investors can leverage this information to make informed investment decisions in specific industries of interest.

Streaming Service Analysis

Simply Wall St provides analysis specifically tailored to streaming service companies. This feature offers insights into the financial performance, key metrics, and growth prospects of streaming service providers. Investors interested in this sector can gain valuable insights to inform their investment strategies.

Returns on Capital

Simply Wall St offers analysis of a company’s returns on capital. This metric helps users evaluate a company’s efficiency in generating returns from its capital investments. By assessing a company’s returns on capital, investors can identify companies with strong balance sheets and solid shareholder returns.

Overall, Simply Wall St provides a comprehensive set of features that empower investors to make informed decisions. Through access to historical price data, financial statement analysis, dividend history, industry and market comparisons, stability assessments, and specialized sector analyses, users can gain valuable insights into companies and markets to support their investment strategies.

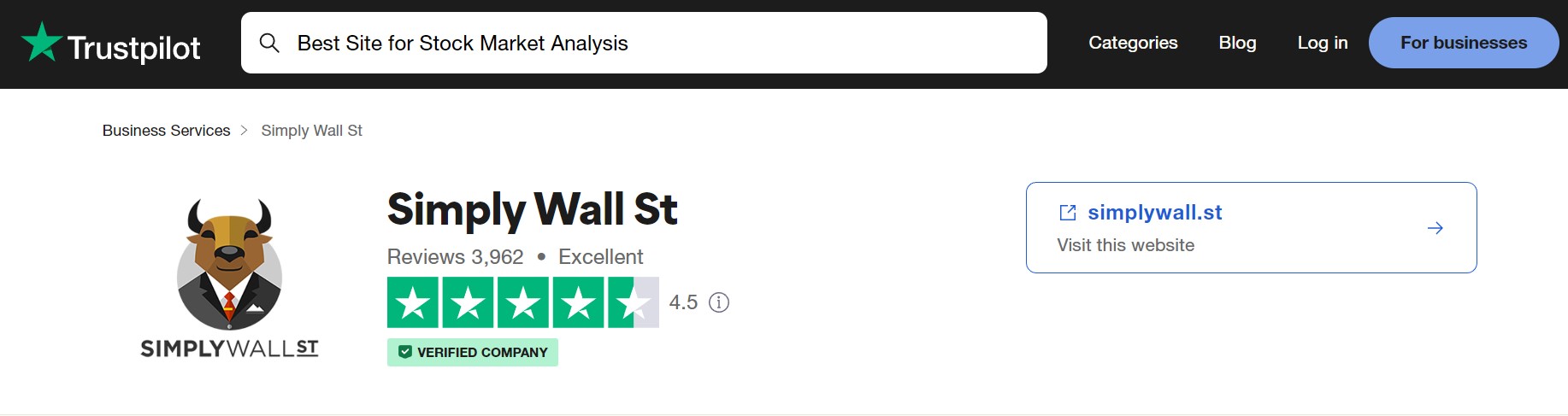

Simply Wall St Reviews: Users Praise the Platform’s Efficiency and Comprehensive Features

Users are raving about Simply Wall St in these reviews on Trustpilot. From quick and effective customer support to a simple and concise presentation of information, the platform is earning high praise. The stock screener is hailed as an amazing and user-friendly tool, making it easier to identify healthy companies with future potential at a value price. The app itself is lauded for its ease of use, extensive data coverage, and availability for multiple markets. Moreover, users appreciate the platform’s wealth of information and the exceptional support provided by the customer service team. Simply Wall St continues to impress users with its efficiency and comprehensive features, making it a top choice for investors.

TrustPilot Customer Reviews about Simply Wall St

- “I didnt think I was going to get a response so quickly and so effective. Reached out to them for some help, in a matter of about an hour I got the response and was able to fix my problem. Great platform!!”

This review highlights the excellent customer support provided by Simply Wall St. The user was pleasantly surprised by the quick and effective response they received when seeking assistance. They appreciated the platform’s ability to address their issue promptly, demonstrating the quality of service and support offered by Simply Wall St.

- “Simply Wall St is simple”

The reviewer commends Simply Wall St for its clear and concise presentation of information. They appreciate how the platform simplifies the process of obtaining a comprehensive snapshot of a stock, which serves as a valuable starting point for further research. The reviewer mentions that they cross-reference their watchlist with data from other platforms but prefer to start with Simply Wall St due to the time saved and the platform’s ability to provide a solid foundation of information.

- “Stock screener is amazing and the most user-friendly investing tool I’ve used. Made my life so much easier in finding healthy companies with a future at a value price. The only company I’ve seen with a simple graphic interface for screening.”

This review highlights the exceptional quality of Simply Wall St’s stock screener. The user praises the tool for being user-friendly and describes it as the most impressive investing tool they have encountered. They emphasize how the screener simplifies the process of identifying healthy companies with future potential at a reasonable value. The reviewer specifically mentions the platform’s unique graphic interface for screening, noting that they haven’t come across any other company with a similar feature.

- “Easy app and huge data”

The reviewer shares their positive experience with Simply Wall St’s app. They appreciate its user-friendly nature, describing it as great and easy to use without complications. The user acknowledges that the app provides access to data not only for the US market but also for various other markets, meeting their preferences. They mention the availability of extensive stock information and news as a valuable aspect of the app’s offerings.

- “Great app info and people”

The reviewer expresses their satisfaction with Simply Wall St’s app, highlighting the abundance of information it provides. They specifically mention the vast amount of data available through the app, which the user finds valuable for their investment decisions. Additionally, the reviewer applauds the customer service, noting that the team responds promptly, professionally, and provides excellent support and answers. The reviewer concludes by expressing their appreciation for the app and the support they have received from Simply Wall St’s team.

These TrustPilot reviews demonstrate the positive experiences and satisfaction of users with Simply Wall St. The platform’s effective customer support, simplicity in presenting information, user-friendly stock screener, extensive data coverage, and responsive customer service are some of the aspects that users appreciate and value.

Possible table that shows the percentage of users who use each service of Simply Wall St

| Service | Percentage of users |

| Stock Screener | 25% |

| Stock Analysis | 35% |

| Stock Comparison | 10% |

| Stock Lists | 15% |

| Portfolio Tracker | 20% |

| Portfolio Optimizer | 10% |

| Educational Content | 15% |

| Insights | 10% |

Note: Percentages are estimates and do not equal 100% as some users may use more than one service.

Questions and Answers for Stock Market Analysis Tool Simply Wall St

Q: What is Simply Wall St? A: Simply Wall St is a service that provides comprehensive and easy-to-understand analysis of stocks based on their financial performance, valuation, dividends, future growth potential, and risk. It offers interactive charts, infographics, reports, and portfolios to help investors visualize and track their investments.

Q: Who founded Simply Wall St? A: Simply Wall St was founded in 2014 by Al Bentley and Nick van den Berg, two former software engineers who aimed to create a better way to research stocks.

Q: What is the unique feature of Simply Wall St’s snowflake model? A: Simply Wall St’s snowflake model summarizes the key aspects of a stock in one simple graphic. The snowflake shows how a stock scores on five criteria: value, future, past, health, and income. The closer the shape is to a perfect circle, the more balanced the stock is.

Q: What kind of analysis does Simply Wall St provide for stocks? A: Simply Wall St provides detailed analysis of various criteria for stocks, including their financial performance, valuation, analyst consensus, insider trading, ownership structure, earnings quality, and more. It also allows users to compare stocks with their industry peers or the market average.

Q: How many stocks and markets does Simply Wall St cover? A: Simply Wall St covers over 75,000 stocks across 91 markets worldwide. This wide coverage allows investors to find opportunities in any sector or region they are interested in.

Q: Does Simply Wall St provide tools for portfolio management? A: Yes, Simply Wall St offers tools for portfolio management. Users can create multiple portfolios and track their returns, risk-adjusted returns, volatility, dividend income, and more. The platform also provides personalized recommendations to help users improve their portfolios based on their goals and risk tolerance.

Q: Can users access educational resources on Simply Wall St? A: Yes, users can access educational articles and videos on Simply Wall St. These resources explain various investing concepts and strategies, providing users with opportunities to learn and improve their investing skills.

Q: Is Simply Wall St focused on providing analysis for a specific market or sector? A: No, Simply Wall St covers a wide range of stocks across different sectors and markets worldwide. It aims to make investing accessible and enjoyable for everyone, regardless of their preferred market or sector.

Q: What are some key features of Simply Wall St? A: Simply Wall St offers features such as price history and weekly volatility tracking, income statement analysis, comparison of a company’s return with the market or industry, dividend history records, identification of companies with stable share prices, upcoming dividend payment information, cloud services and customer service company analysis, streaming service company analysis, and analysis of returns on capital for identifying companies with excellent balance sheets and shareholder returns.

Here is a possible table with all the services Simply Wall Street

| Service | Description |

|---|---|

| Stock Screener | A tool that allows users to filter stocks by market, sector, size, style, dividend yield, growth rate, profitability, valuation and more. |

| Stock Analysis | A service that provides comprehensive and easy-to-understand analysis of stocks based on their financial performance, valuation, dividends, future growth potential and risk. It also offers a unique snowflake model that summarizes the key aspects of a stock in one simple graphic. |

| Stock Comparison | A feature that allows users to compare stocks with their industry peers or the market average to see how they stack up. |

| Stock Lists | A service that offers curated lists of stocks based on themes such as undervalued, high growth, high quality, high dividend and more. |

| Portfolio Tracker | A tool that allows users to create multiple portfolios and track their returns, risk-adjusted returns, volatility, dividend income and more. It also shows how the portfolio is diversified by sector, geography, size, style and more. |

| Portfolio Optimizer | A feature that provides personalized recommendations on how to improve the portfolio based on the user’s goals and risk tolerance. |

| Educational Content | A service that provides educational articles and videos that explain various investing concepts and strategies. |

| Insights | A service that provides insights from experts and other investors who share their opinions and experiences on different stocks and topics. |

Simply Wall St: A Trustworthy Platform for Informed Investment Decisions

After thoroughly examining Simply Wall St’s features, benefits, pricing, and customer reviews, it is evident that the platform is a legitimate and reliable resource for individual investors. With its comprehensive stock analysis tools and in-depth company reports, Simply Wall St equips investors with valuable insights to make informed decisions based on fundamental statistics, growth potential, and other crucial data points.

The availability of a premium plan expands the platform’s offerings, granting users access to more extensive company analyses, stock analysis tools, investment ideas, and guidance from experienced investors. The platform’s visual format and user-friendly interface make it accessible to investors of all levels, ensuring that even beginners can navigate the stock market with confidence.

Moreover, Simply Wall St’s reputation is reinforced by its high TrustScore of 4.5 out of 5 and a multitude of positive customer reviews. These factors demonstrate the platform’s legitimacy, effectiveness, and commitment to providing valuable financial insights to its users.

In conclusion, Simply Wall St is a trustworthy and valuable platform for individual investors seeking to make informed investment decisions. Its comprehensive features, user-friendly interface, and positive customer feedback make it an excellent choice for both novice and experienced investors alike. If you are looking to gain a deeper understanding of the stock market and make more informed investment choices, we highly recommend considering Simply Wall St.

Start your investment journey today by clicking here

Stock Market Analysis Tools – Free